Bitcoin’s impressive rally above $90,000 has reignited hopes of reaching the highly anticipated $100K milestone. However, emerging on-chain metrics and market sentiment suggest that Bitcoin may face a significant correction, with prices potentially falling 10-15% to below $80,000 before resuming its upward momentum. Here are five critical factors pointing towards this possible pullback.

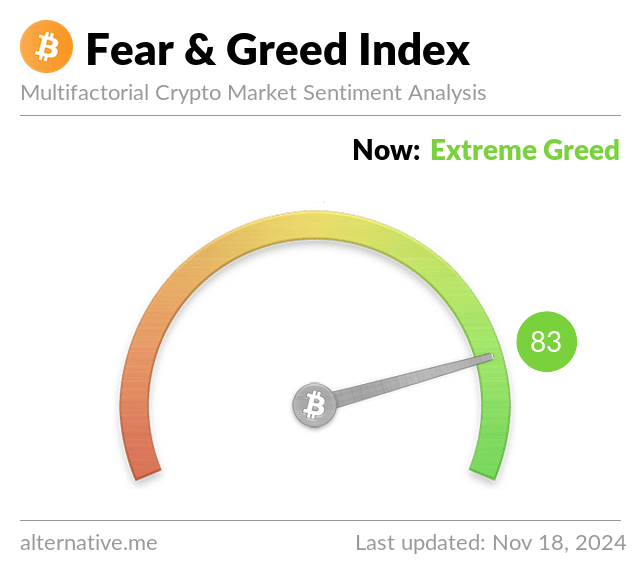

1. Extreme Greed Dominates the Market

The Bitcoin Fear and Greed Index, which gauges market sentiment, currently reads 83/100—indicating “Extreme Greed.” Historically, such high levels of greed often precede market corrections as retail investors flood in, driven by FOMO (fear of missing out).

Supporting this sentiment, Google searches for Bitcoin have surged dramatically, further signaling heightened retail enthusiasm. Overheated retail participation, paired with market greed, often leads to increased volatility and profit-taking by larger players.

2. Increased Profit-Taking Signals Sell Pressure

Bitcoin investors have been cashing in on the recent rally, realizing approximately $5.42 billion in profits. This spike in profit realization has coincided with a rise in the Sell-Side Risk Ratio, which now sits at 0.524%, a level that historically indicates heightened selling pressure.

As profit-taking accelerates, the likelihood of a pullback increases, signaling caution for those looking to enter the market at current levels.

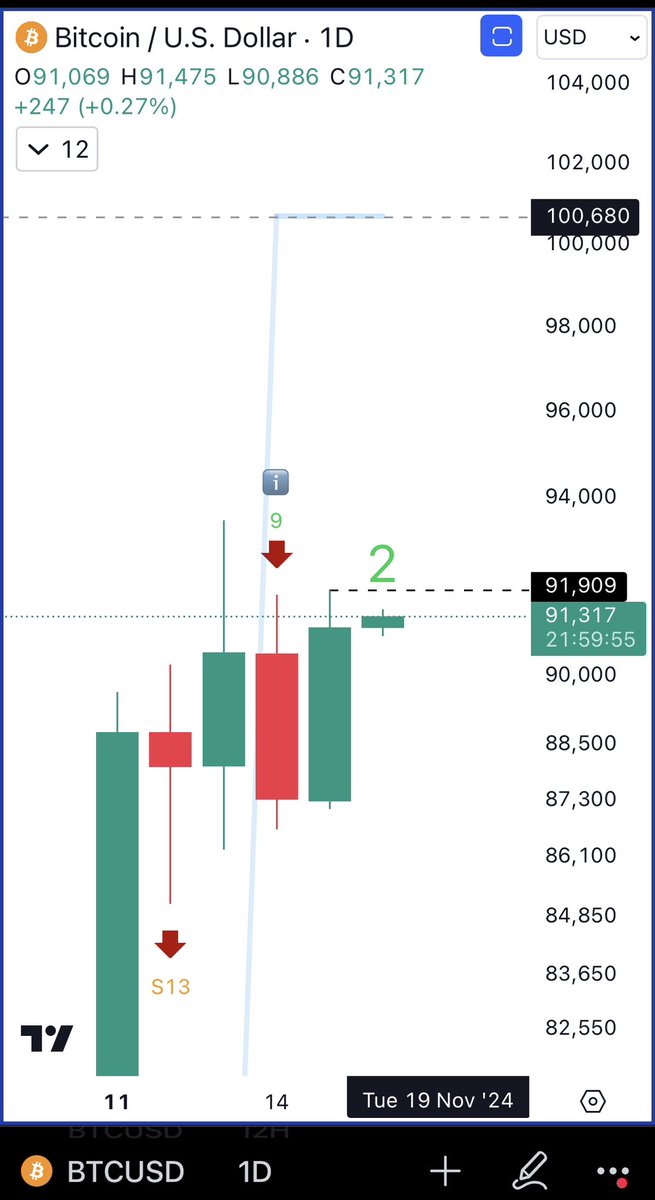

3. Technical Indicators Flash Sell Signals

The TD Sequential Indicator, a tool used to predict market reversals, has flashed a sell signal on Bitcoin’s daily chart. Unless Bitcoin closes above $91,900 in the near term, this signal could point to a correction, potentially delaying the rally to $100K.

Additionally, the Relative Strength Index (RSI) suggests that Bitcoin is firmly in overbought territory, exceeding the threshold of 70. Overbought conditions often precede price retracements, as traders look to lock in gains.

4. Miner Selloffs Add to Bearish Momentum

Bitcoin miners, key participants in the ecosystem, have begun offloading their holdings amid the recent rally. These selloffs come as mining companies reported lower-than-expected revenues in the previous quarter.

This miner-driven selling pressure, combined with profit-booking by investors, adds to the bearish sentiment and could slow down the path to $100K.

5. Key Support Levels in Focus

If Bitcoin’s price experiences a pullback, analysts have identified two critical support zones:

- $85,800 – $83,250: This is the first major level where strong buyer interest is expected.

- $75,520 – $72,880: A deeper correction could bring Bitcoin into this range, which has been historically significant in terms of demand.

These zones represent areas where investors previously accumulated Bitcoin, making them potential levels for the price to stabilize during a downturn.

Conclusion: Caution Ahead Amid Tight Bull-Bear Battle

As of now, Bitcoin trades at $91,160, with a market cap of $1.8 trillion. While the long-term outlook for Bitcoin remains bullish, the current market setup suggests a period of consolidation or correction before the next leg higher.

Investors and traders should keep a close eye on these on-chain metrics and support levels, as they will likely dictate Bitcoin’s trajectory in the short term. While the $100K target remains within reach, a healthy correction could provide a more solid foundation for sustained growth.

Remember: Always conduct thorough research and risk assessment before making investment decisions.

Stay tuned for more insights into the hottest trends shaping the crypto market! DYOR 🚀

Twitter: @KenyaCryptoMag

Instagram: @kenyacryptomag

WhatsApp: Join our group

ENG WANJIKU

Views: 51