Cryptocurrency wallets are essential tools in the world of digital assets, acting much like a bank where you can store your crypto securely. There are various types of wallets, each with its unique features, advantages, and considerations. In this blog, we’ll dive into the two main types of crypto wallets: hot wallets and cold wallets. We’ll also explore wallet addresses, seed phrases, and the differences between custodian and non-custodian wallets, including examples of each type.

1. Hot Wallets: The Digital Access Points

Hot wallets are the most common type of cryptocurrency wallets. These are digital wallets connected to the internet, allowing for quick and easy access to your funds. You can access a hot wallet through a web browser or a mobile application, making it convenient for day-to-day transactions.

- Accessibility: Hot wallets provide immediate access to your funds at any time, from anywhere with an internet connection.

- Cost: Most hot wallets are available for free, supporting multiple platforms, which adds to their convenience.

- User-friendliness: They are beginner-friendly, making them ideal for those new to cryptocurrency. Additionally, they often provide multiple backup options to ensure your funds remain secure.

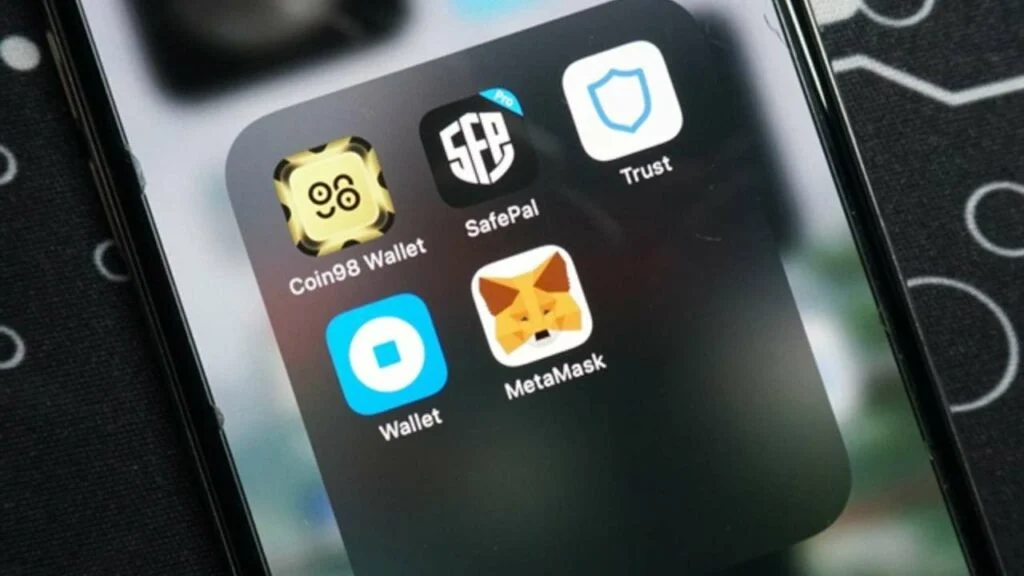

Examples of Hot Wallets:

- MetaMask: A popular browser extension that supports Ethereum and other ERC-20 tokens.

- Trust Wallet: A mobile wallet that supports a wide range of cryptocurrencies.

- Coinbase Wallet: A user-friendly wallet provided by the popular exchange Coinbase.

However, because hot wallets are connected to the internet, they are inherently more vulnerable to cyber-attacks. They run on centralized servers, which are prime targets for hackers. Moreover, these servers may face transaction delays due to high network traffic.

2. Cold Wallets: Offline Security

On the other hand, cold wallets are not connected to the internet, making them significantly more secure. These wallets can take the form of a physical device or even a piece of paper. Before hardware wallets became common, the paper wallet was considered the most secure way to store digital assets.

- Security: Cold wallets offer a safer storage option compared to hot wallets, as they are immune to online hacking attempts.

- Cost: Unlike hot wallets, cold wallets are not free. They are sold by various manufacturers and should be considered when you hold a significant amount of cryptocurrency.

- Suitability: For small amounts of cryptocurrency, a cold wallet might not be necessary as the cost of the wallet might be comparable to the value of your crypto holdings. For instance, if you have $200 worth of crypto or less, the cost of a cold wallet could be similar to the crypto’s value.

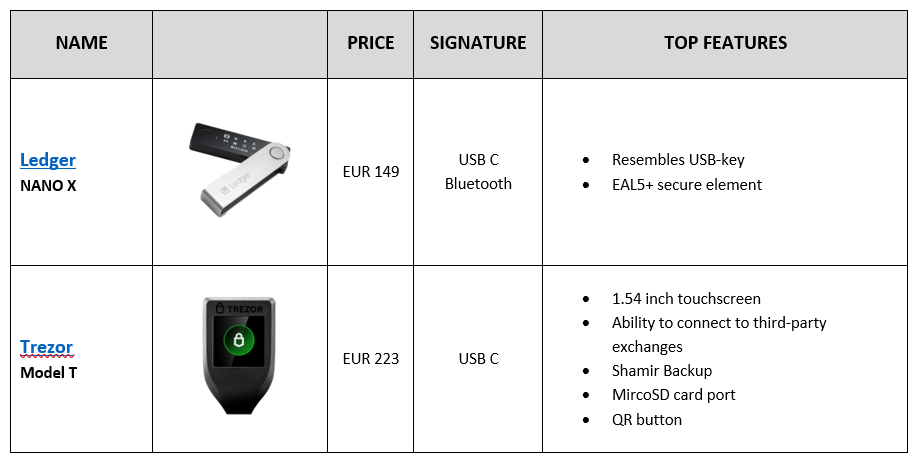

Examples of Cold Wallets:

- Ledger Nano S/X: A popular hardware wallet that supports multiple cryptocurrencies.

- Trezor: Another well-known hardware wallet, offering top-notch security features.

- Paper Wallets: A piece of paper with your private and public keys printed, used for offline storage.

Interestingly, about 78% of Bitcoin’s supply is stored in cold storage, highlighting the importance of security in the crypto world.

3. Wallet Addresses: Your Digital Account Number

A wallet address is akin to your bank account number in the traditional financial system. It’s an alphanumeric string used to receive cryptocurrency, for example: 1JNNGhoEeSDVFCcWQvmeLuteDgXU88JopE. This address is what you share with others when they want to send you crypto.

- Alphanumeric Nature: The wallet address is composed of both letters and numbers, ensuring a unique identifier for every user.

- Privacy and Security: While the wallet address is public and can be shared, it’s important to keep other related information, such as your seed phrase, private.

4. Seed Phrases: The Key to Your Wallet

A seed phrase, also known as a recovery phrase, is a critical component of your crypto wallet. It acts as a password to your wallet and is the only way to recover your wallet if you lose your device.

- Importance: The seed phrase is extremely important and should be written down and stored in a secure place. Never store your seed phrase online.

- Structure: A seed phrase typically consists of 12, 18, or 24 words, depending on the wallet. This phrase is unique to your wallet and must be kept safe.

In the event of losing your seed phrase, there is no way to recover your funds, even if you have billions stored in the wallet. This is why it’s crucial to handle your seed phrase with care.

5. Custodian vs. Non-Custodian Wallets

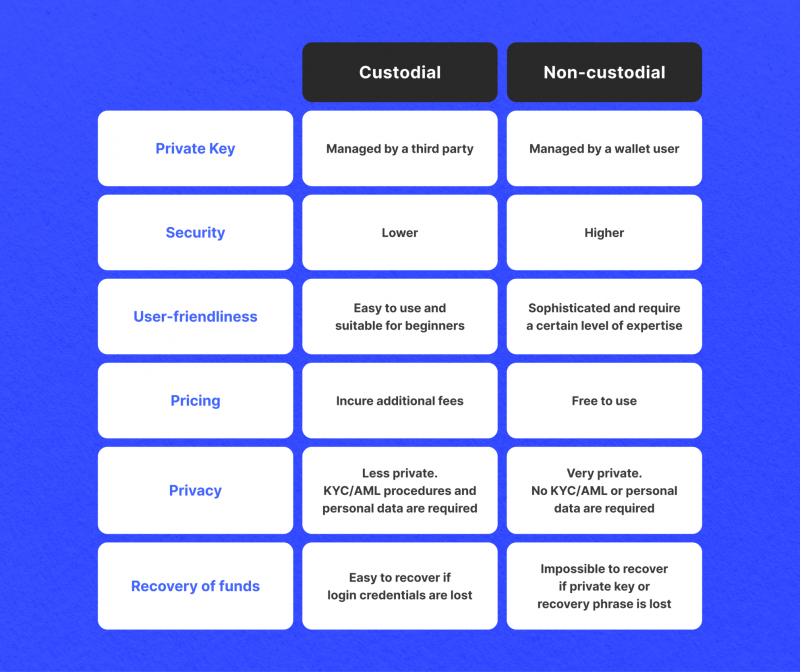

The distinction between custodian and non-custodian wallets is essential for understanding who controls your funds.

- Custodian Wallets: In these wallets, you do not have access to the private keys. This means that a third-party entity, such as an exchange, controls your funds. While this can be convenient, it also means you are relying on the security of that entity. Examples of Custodian Wallets:

- Binance Wallet: A wallet provided by the Binance exchange.

- Kraken Wallet: A wallet provided by the Kraken exchange.

- Coinbase Wallet (in-app wallet): When using the Coinbase app, the funds are controlled by Coinbase.

- Non-Custodian Wallets: These wallets give you access to your private keys, putting you in full control of your funds. However, with this control comes the responsibility of safeguarding your private key and seed phrase. Examples of Non-Custodian Wallets:

- Exodus: A desktop and mobile wallet that gives you control over your private keys.

- Atomic Wallet: A multi-currency wallet where you own the keys.

- Ledger Nano S/X: As a cold wallet, it falls under non-custodial wallets.

Cold wallets also fall into the non-custodian category, typically containing a 24-word seed phrase. The security they offer is unmatched, but losing the seed phrase means losing access to your funds forever.

Conclusion

Understanding the different types of cryptocurrency wallets, their functions, and the importance of securing your private keys and seed phrases is crucial in the world of digital assets. Whether you opt for a hot wallet for ease of access or a cold wallet for enhanced security, the choice depends on your needs and the value of your holdings.

Always prioritize security by using cold storage for significant amounts of crypto and keeping your seed phrases safe. As you navigate the crypto world, remember that being informed and vigilant is your best defense against potential risks.

ENG WANJIKU

Views: 18