What Are Smart Contracts?

At their core, smart contracts are self-executing contracts in which the terms of the agreement between buyer and seller are written directly into lines of code. The code and the agreements contained within it exist across a distributed, decentralized blockchain network. The most common platform for deploying smart contracts is Ethereum, although other blockchains like Solana, Binance Smart Chain, and Polkadot also support smart contracts.

Unlike traditional contracts, which require intermediaries (such as lawyers, brokers, or banks) to oversee and enforce the contract’s terms, smart contracts automatically execute and enforce the terms when pre-established conditions are met. Once deployed, they run exactly as programmed, without the need for a middleman.

How Do Smart Contracts Work?

To understand smart contracts, it’s important to break down how they operate:

- Creation and Agreement:

- A smart contract is written using a programming language, with Solidity being the most popular language on Ethereum.

- The contract contains logic in the form of conditional statements: IF/THEN/ELSE. For example, “IF Party A sends 2 ETH to the contract, THEN the contract sends Product X to Party A’s wallet address.”

- Once the contract is coded, it is deployed to the blockchain. The code is stored on the decentralized network, and anyone can verify the logic.

- Decentralized Execution:

- Once conditions in the contract are met, the contract executes automatically. In decentralized finance (DeFi), this could mean transferring funds, releasing collateral, or liquidating an asset. In supply chain management, it could mean confirming the delivery of goods.

- Each action the smart contract takes is recorded on the blockchain, providing a permanent and transparent record that cannot be altered.

- Self-verification and Autonomy:

- Smart contracts are self-executing and self-verifying, meaning that they do not rely on a third party to verify that conditions have been met. The blockchain itself acts as the “enforcer,” ensuring that the contract terms are executed exactly as written.

- No one can interfere with the execution once the contract is deployed, making it trustless and secure.

Key Components of Smart Contracts

- Code Logic:

- The contract is essentially a program consisting of rules and conditions. This logic defines what will happen under certain circumstances. For example, if a user deposits cryptocurrency into a DeFi lending platform, the logic in the smart contract will automatically calculate interest and update the user’s balance in real-time.

- Blockchain Infrastructure:

- The blockchain that hosts the smart contract ensures that all nodes (computers in the network) have a copy of the contract and its state. This decentralized infrastructure ensures transparency and prevents manipulation.

- Digital Signatures:

- Parties involved in the contract use cryptographic keys to “sign” transactions. These signatures serve as an authorization mechanism, verifying the identity of participants without needing to reveal their identities.

Characteristics and Advantages of Smart Contracts

- Autonomy and Trustless Nature:

- Once deployed, no one controls the contract, not even its creator. This ensures that both parties can trust the contract will execute as written, without worrying about third-party manipulation.

- Transparency:

- Because smart contracts are stored on a blockchain, anyone can audit the contract’s code and see the transactions executed by the contract. This ensures transparency and trust.

- Cost-Efficiency:

- By eliminating intermediaries, smart contracts significantly reduce transaction costs. For example, in traditional financial systems, intermediaries like banks or payment processors take a fee for their services. With smart contracts, these fees are minimized or eliminated.

- Security:

- Smart contracts inherit the security of the blockchain they’re hosted on. The decentralized nature of blockchain, combined with cryptography, makes it extremely difficult for bad actors to manipulate or tamper with contracts.

- Accuracy:

- The precise nature of smart contracts eliminates the ambiguity that may exist in traditional contracts. Since the terms are defined clearly in code, there is no room for misinterpretation.

Real-World Applications of Smart Contracts

- Decentralized Finance (DeFi):

- In DeFi, smart contracts enable complex financial activities like lending, borrowing, and trading to occur autonomously, without the need for traditional banks. For example, platforms like Aave and Compound allow users to deposit cryptocurrencies and earn interest, all governed by smart contracts.

- Insurance:

- In parametric insurance, smart contracts are used to automatically trigger payouts based on specific events, such as flight delays or natural disasters. The contract accesses external data (known as oracles) to verify if the conditions for payout have been met.

- Supply Chain Management:

- Smart contracts can track goods as they move through the supply chain, automatically triggering payments or transfers of ownership once delivery conditions are met. This reduces fraud, ensures transparency, and streamlines logistics.

- Gaming and NFTs:

- Smart contracts are widely used in the gaming industry for handling in-game assets and transactions. Non-fungible tokens (NFTs), which represent ownership of unique digital items, rely on smart contracts to authenticate and transfer ownership.

- Real Estate:

- In real estate, smart contracts can be used to automate the property buying process. For example, a smart contract can transfer property ownership once a buyer’s payment has been confirmed on the blockchain. This reduces paperwork, speeds up transactions, and ensures both parties uphold their end of the deal.

Potential Drawbacks and Challenges

While smart contracts have numerous advantages, they also come with certain limitations:

- Immutability:

- Once deployed, smart contracts are immutable, meaning they cannot be changed. While this ensures security, it also means that any bugs or errors in the contract cannot be easily fixed. In cases where funds are locked due to a faulty contract, this can lead to substantial financial loss.

- Complexity and Vulnerability:

- Writing a secure and efficient smart contract requires expertise. A small error in the code can lead to unintended consequences, such as exploits or vulnerabilities that hackers can use to drain funds from the contract.

- Legal Ambiguity:

- Since smart contracts operate in the digital world, they may not always align with existing legal frameworks. Questions about enforceability, especially in traditional legal systems, remain a challenge for widespread adoption.

- Dependence on External Data:

- Smart contracts are dependent on external data (such as real-world events) to execute certain functions. This data is often provided by oracles, which act as intermediaries between the blockchain and off-chain information. However, reliance on oracles introduces a potential point of failure, as incorrect or manipulated data can disrupt the contract’s execution.

Conclusion

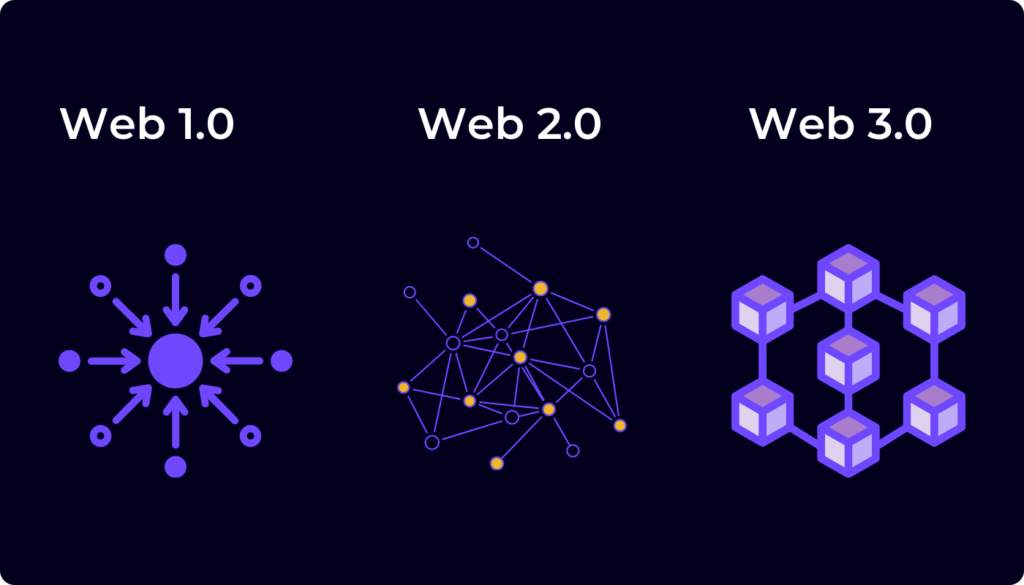

Smart contracts are fundamentally changing the way agreements are made and executed in the digital age. By combining automation, security, transparency, and decentralization, smart contracts offer a powerful alternative to traditional contracts. However, their potential is not without risk, and developers must take care to ensure their code is secure and error-free. As Web3 and blockchain adoption continues to grow, smart contracts will play an increasingly pivotal role in transforming industries from finance to real estate, insurance, and beyond.

Incorporating smart contracts into your Web3 course will provide learners with a comprehensive understanding of how blockchain technology automates trust and transparency in digital agreements.

ENG WANJIKU

Views: 4