On October 1st, Ripple will unlock 1 billion XRP tokens from its escrow, an event that has become a regular occurrence in the cryptocurrency space. Valued at approximately $640 million, this unlock will follow Ripple’s standard monthly schedule as part of its ongoing plan to gradually release XRP from escrow into the market. But what does this release mean for the crypto industry, and how could it affect XRP prices, market sentiment, and Ripple’s future growth?

Breaking Down the XRP Unlock: The Escrow Plan

Ripple holds the majority of its XRP in escrow accounts, with the company periodically releasing a set amount each month. This strategy was first initiated to ensure a controlled supply and avoid flooding the market with XRP, which could significantly impact its price and stability. Since 2017, Ripple has followed a schedule where 1 billion XRP is unlocked every month.

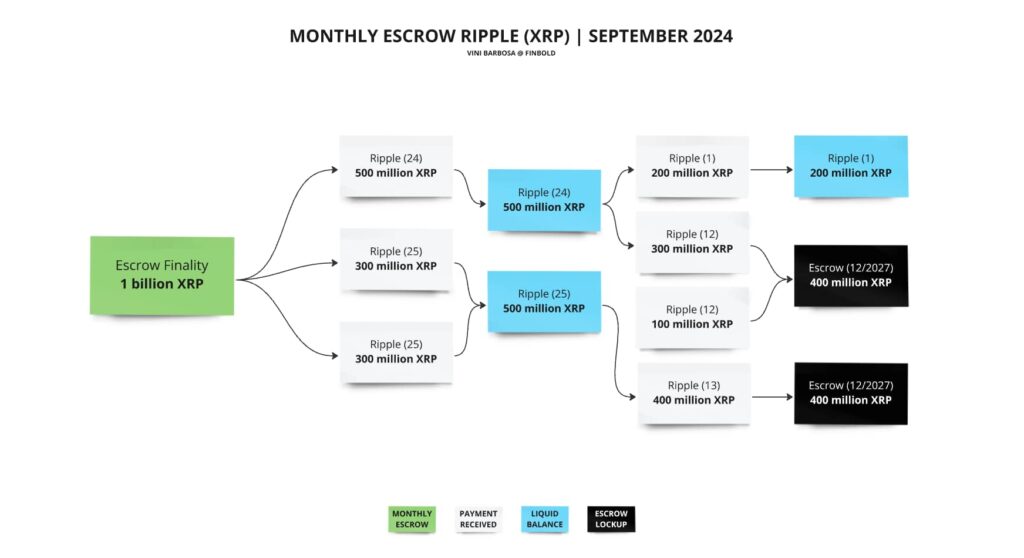

This coming October 1st, the breakdown of the 1 billion XRP release is as follows:

- 500 million XRP will be released from Ripple (24) escrow

- 400 million XRP will be released from Ripple (25) escrow

- 100 million XRP will be released as an additional boost to market liquidity

With this strategic release, Ripple ensures the gradual introduction of XRP into the ecosystem, primarily to support its operations and partnerships. These releases often boost XRP’s sales, although Ripple typically doesn’t offload the entire amount at once, but reserves a portion to re-lock in escrow.

Ripple’s Escrow System: A Closer Look

Ripple’s escrow system is designed to enhance trust and transparency in its XRP tokenomics. When Ripple locked 55 billion XRP into a cryptographically-secured escrow account in December 2017, it reassured investors and the market that the token wouldn’t be dumped on exchanges unpredictably. Ripple’s approach has helped stabilize XRP, allowing for sustainable growth and adoption.

Every month, Ripple unlocks 1 billion XRP, but the amount sold on the open market is far less. A portion of the unlocked XRP is typically reserved for institutional sales, partnerships, and operational expenses. The remainder is re-escrowed, preventing a complete supply flood. This controlled release helps Ripple develop its ecosystem while keeping market disruptions in check.

Why October’s 1 Billion XRP Unlock Matters

This upcoming XRP unlock is particularly significant given the current landscape in the crypto world. Ripple’s legal battles with the U.S. Securities and Exchange Commission (SEC) have placed XRP under intense scrutiny. However, Ripple’s recent victories in court, such as the SEC’s partial loss regarding the classification of XRP as a security, have positively impacted XRP’s market sentiment.

Additionally, the market has been witnessing an increasing demand for utility-based cryptocurrencies. XRP has a unique use case in facilitating cross-border payments, making it one of the most utility-driven digital assets. Ripple’s partnerships with major financial institutions globally further cement XRP’s role in transforming the traditional payment ecosystem.

With this context in mind, Ripple’s decision to release 1 billion XRP at a time when market confidence is building could serve as a confidence booster for both investors and institutional partners. The funds generated from the release can also be used to bolster ongoing projects and new developments in Ripple’s ecosystem, ultimately driving innovation.

What Will Ripple Do with the Unlocked XRP?

Ripple’s unlocked XRP typically serves several purposes:

- Operational Costs: Ripple uses part of the XRP to cover its day-to-day expenses, including salaries, technological development, and maintaining partnerships.

- Institutional Sales: A significant portion of the released XRP is sold to institutional investors and partners. This helps Ripple sustain and expand its global network of financial institutions leveraging XRP for cross-border payments.

- Market Sales: While Ripple occasionally sells XRP directly into the market, they have maintained that the amounts sold are carefully measured to avoid major price drops or market disruptions.

- Re-Escrow: After the month’s sales and operational needs are accounted for, Ripple often locks up any unsold XRP back into escrow. This ensures that the supply is tightly controlled, which helps prevent inflation and promotes price stability.

Impact on XRP Price and Market Sentiment

One of the biggest concerns during every XRP unlock is the potential impact on the price of the token. Historically, Ripple’s monthly release has not drastically affected the XRP price because of the company’s controlled and calculated approach. However, market forces, investor sentiment, and macroeconomic factors like the global regulatory environment can always influence how these tokens are absorbed by the market.

The scheduled 1 billion XRP unlock for October 1st is unlikely to significantly destabilize the market, especially with only a portion expected to be sold immediately. The release could even inject liquidity into the market, making it easier for institutions and investors to acquire XRP for cross-border payments and other use cases.

Additionally, Ripple’s ongoing partnership developments, such as those with financial institutions and payment service providers, are expected to drive long-term demand for XRP. These positive developments can offset any immediate negative price pressure caused by the unlock.

Ripple’s Road Ahead

As Ripple continues to navigate the regulatory landscape, its controlled escrow system provides both transparency and confidence in the market. The company’s strategic management of XRP, especially through planned unlocks like the upcoming one on October 1st, allows it to maintain its focus on enhancing cross-border payment systems without disrupting the market.

With regulatory clarity emerging in many countries and Ripple’s increasing global footprint, XRP is set to play a vital role in the world of digital finance. The upcoming unlock of 1 billion XRP, valued at $640 million, is just another step in Ripple’s ongoing mission to boost global financial inclusion through blockchain technology.

As XRP continues to gain traction, both as an investment asset and as a cross-border payment facilitator, Ripple’s monthly releases will remain a closely watched event in the crypto community. For now, it’s clear that Ripple’s controlled approach to its escrow ensures that market stability is prioritized, while opportunities for growth and innovation in the blockchain space are maximized.

ENG WANJIKU

Views: 5