For decades, people have trusted traditional savings accounts as a safe way to grow their wealth over time. But in today’s rapidly changing financial landscape, that old paradigm seems outdated—if not outright deceptive. In fact, the idea that you can achieve financial freedom by letting your money sit idle in a savings account is becoming increasingly questionable. A powerful argument can be made that saving in fiat (traditional currency) is, at its core, a fraud compared to what could be achieved by investing in high-performing assets like Bitcoin and other cryptocurrencies.

The Shocking Reality of Fiat Savings

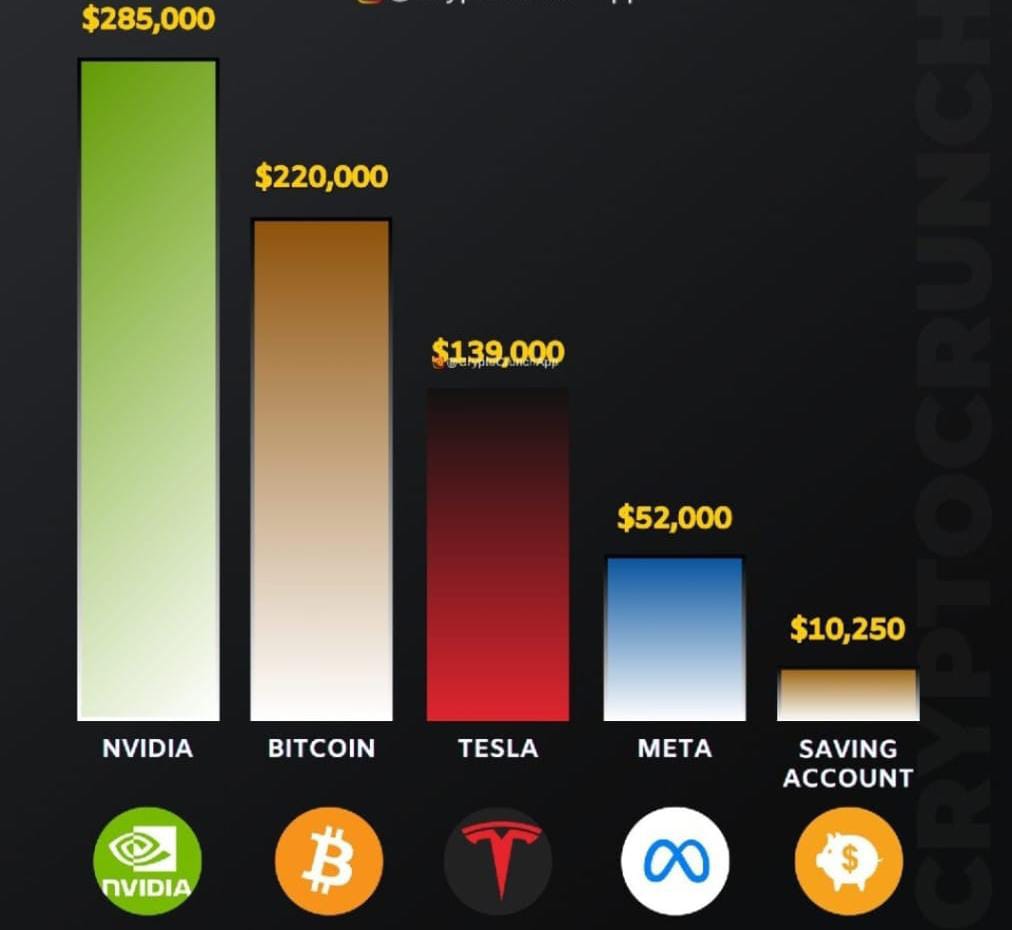

Let’s break it down with some simple math. According to the image shared from CryptoCrunchApp, $10,000 saved in a traditional savings account over the past five years would have grown to a mere $10,250. That’s barely keeping up with inflation. Compare this to the same $10,000 invested in Bitcoin, which would have turned into an astonishing $220,000. Meanwhile, the stock market also provided exceptional returns: $285,000 from Nvidia, $139,000 from Tesla, and $52,000 from Meta.

Clearly, traditional savings accounts are falling behind, offering little more than a false sense of security.

Bitcoin and Cryptos: The Real Winners

Over the last five years, Bitcoin has consistently outperformed traditional assets, solidifying its place as one of the best investments of the decade. While Nvidia and Tesla stocks have done exceedingly well, Bitcoin’s rise has been nothing short of remarkable. From a fringe technology with skeptics to a mainstream asset adopted by institutions, Bitcoin has proven its potential as a store of value and investment vehicle.

The lesson here is that fiat currency doesn’t offer the same growth potential as Bitcoin and other high-return assets, especially in a world where inflation continues to eat into purchasing power.

The Rise of Altcoins: A Glimpse Into the Future

While Bitcoin’s performance has been incredible, it’s also essential to examine the role of altcoins (alternative cryptocurrencies). Over the past five years, several altcoins have yielded even more impressive returns, though they come with added risks.

Popular altcoins like Ethereum, Solana, and Cardano have seen massive growth due to their unique use cases in decentralized finance (DeFi), smart contracts, and blockchain innovations. Ethereum, for example, has become the backbone of DeFi applications, NFTs, and smart contracts, earning it a massive following and driving its price exponentially higher since its inception.

These altcoins offer investors opportunities to diversify beyond Bitcoin, with some even outperforming Bitcoin over certain timeframes. However, investors should approach them cautiously due to their volatility and potential regulatory risks.

Why “Saving” Should Be Replaced With “Investing”

The financial system has long pushed the narrative that savings accounts are the best way to grow wealth safely. While it’s true that savings accounts offer low risk, the returns they provide do not keep up with the increasing cost of living or inflation. In contrast, Bitcoin, altcoins, and even tech stocks have shown they can offer substantial returns on investment, outperforming traditional fiat savings by orders of magnitude.

By holding your wealth in fiat, you’re effectively allowing inflation to erode your purchasing power. On the other hand, by putting your money into assets like Bitcoin, altcoins, or stocks, you let your wealth work for you and compound over time, offering the possibility of financial freedom and growth.

Investing Tips for the Crypto-Curious

If you’re ready to leave behind the outdated practice of relying on fiat savings accounts, here are some tips for getting started in the world of crypto investments:

- Start Small: If you’re new to cryptocurrencies, consider starting with Bitcoin or Ethereum, as they are among the most established and stable digital assets.

- Diversify: Don’t put all your eggs in one basket. Consider holding a variety of assets—Bitcoin, altcoins, and even some traditional stocks—to balance risk and reward.

- Stay Informed: The crypto market is highly volatile and constantly evolving. Stay updated on trends, regulations, and market movements to make informed decisions.

- Consider Long-Term Holding: Cryptocurrencies can be highly volatile in the short term. For many investors, long-term holding (often referred to as “HODLing”) has proven to be a rewarding strategy, particularly with Bitcoin.

- Watch for Opportunities: Keep an eye on altcoin projects that offer innovative solutions or technologies, such as those in DeFi, NFTs, and blockchain infrastructure.

Conclusion: Invest Smart, Ditch Fiat

The numbers don’t lie: savings in fiat is a losing game when compared to the returns on Bitcoin, altcoins, and even traditional stocks. While fiat currencies will always have their place for day-to-day transactions, they are no longer the ideal vehicle for building wealth. Instead, savvy investors are looking to Bitcoin and a range of other assets to ensure their money grows over time, rather than stagnating in a low-interest savings account.

The key takeaway here is clear—if you want to achieve significant financial growth, it’s time to move away from the outdated practice of fiat savings and explore the wealth-building opportunities offered by cryptocurrencies and other high-growth assets.

ENG WANJIKU

Views: 2