As excitement builds ahead of the October 8 documentary that promises to reveal the identity of Bitcoin’s creator, Satoshi Nakamoto, a Bitcoin whale from the Satoshi era has moved $3.6 million in BTC to the Kraken exchange. This move, involving 221 BTC purchased in 2009, has fueled speculation about the whale’s connection to Nakamoto.

Highlights:

- A 2009 Bitcoin whale moved $3.6M in BTC to Kraken, coinciding with the upcoming documentary on Satoshi Nakamoto’s identity.

- Bitcoin reserves on exchanges hit a 6-year low, driving bullish sentiment as BTC trades at $62,376.

- Institutional demand for Bitcoin surges, with the highest ETF daily buys since July.

Whale Movements and Nakamoto Speculation

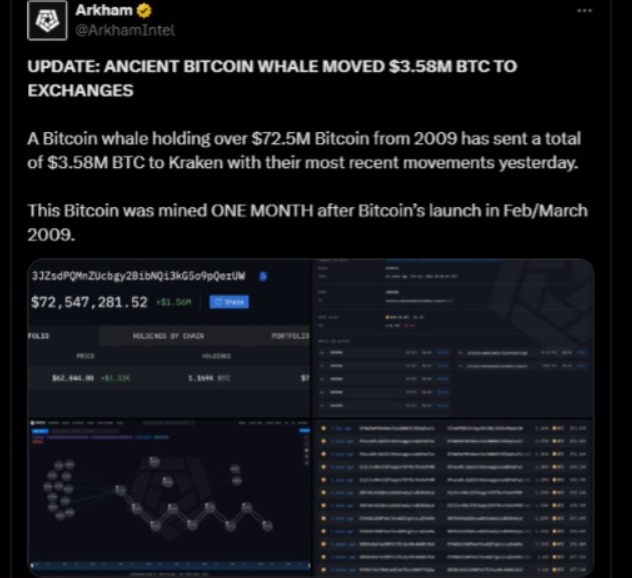

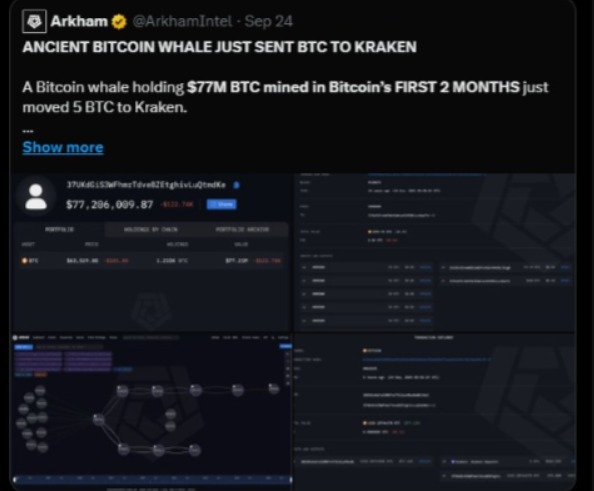

The whale’s transaction, recorded by Arkham Intelligence, shows a history of BTC ownership dating back to the early days of Bitcoin’s launch. Some speculate the whale may be closely connected to Nakamoto. This is the second notable movement by this whale, following a smaller transaction in September 2024. The whale currently holds 1,215 BTC, worth over $72.5 million.

Market Optimism Amid Economic Data

Bitcoin’s price surge to $62,376 is also supported by strong U.S. job data, with nonfarm payrolls exceeding expectations. The bullish sentiment is further boosted by Bitcoin’s decreasing liquidity on centralized exchanges, a sign of limited selling pressure. With only 2.8 million BTC held on exchanges, analysts predict upward price momentum.

Upcoming Documentary Fuels Interest

The documentary directed by Cullen Hoback, known for his investigative work, has intensified speculation about Satoshi Nakamoto’s identity. Many now point to Len Sassaman, a cryptographer and privacy advocate, as the potential Bitcoin creator, particularly due to his work in cryptographic technologies and his death shortly after Nakamoto’s final public communication in 2011.

Institutional Demand Signals Confidence

Meanwhile, institutional investors have been buying Bitcoin at the highest rate since July, reversing their previous selling behavior. The surge in institutional demand for spot Bitcoin ETFs, coupled with declining exchange liquidity, signals a strong long-term outlook for Bitcoin as 2024 progresses.

ENG WANJIKU

Views: 19