Understanding Liquidations in the Crypto Market

Liquidations in cryptocurrency markets occur when a trader’s position is forcibly closed by the exchange due to insufficient margin to cover potential losses. This often happens during periods of heightened volatility when the price of an asset moves significantly in a short period. Leveraged traders, those who borrow funds to amplify their positions, are particularly vulnerable to liquidations.

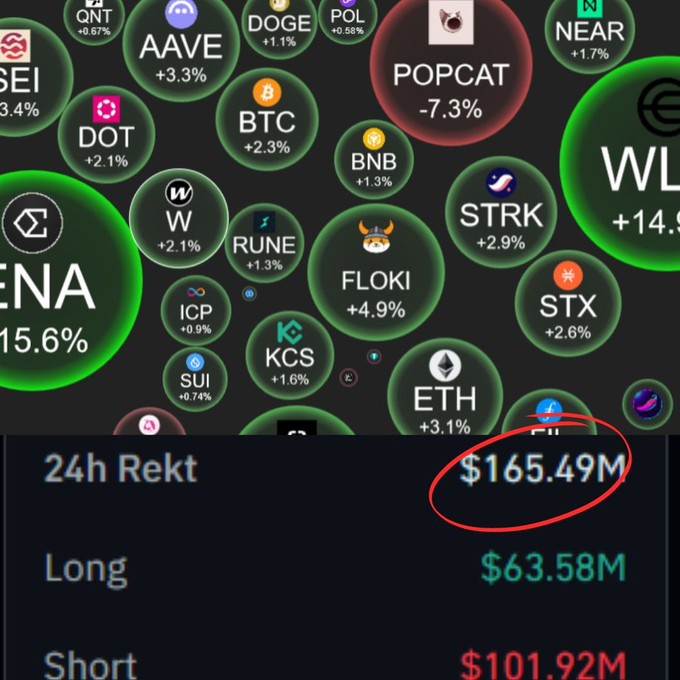

When markets experience sharp movements, as we saw in the last 24 hours, it can trigger a cascade of liquidations. In this case, over $165 million was wiped out, primarily affecting leveraged long and short positions across various exchanges. As prices swung, those who couldn’t meet their margin requirements saw their positions closed, adding fuel to the volatility fire.

The Role of Leverage in the Liquidation Wave

Many traders in the crypto space use leverage to enhance their potential profits. While leverage can lead to significant gains in a favorable market, it also carries substantial risk. The higher the leverage, the more likely a position is to be liquidated if the market moves against the trader.

In this instance, the market saw a sharp price movement, resulting in the liquidation of positions that couldn’t sustain the fluctuation. This liquidation event is a reminder of the risks associated with using leverage in an inherently volatile market like cryptocurrency. The use of excessive leverage can create a domino effect, leading to more liquidations as prices continue to shift.

The Bulls Are Back: What Triggered This Liquidation Event?

The surge in liquidations coincides with a broader recovery in the cryptocurrency market, with Bitcoin and other major cryptocurrencies experiencing renewed upward momentum. While the exact cause of the liquidation wave isn’t entirely clear, there are a few contributing factors to consider:

- Institutional Interest and Positive Sentiment: Institutional investors and hedge funds have been increasing their exposure to cryptocurrencies, particularly Bitcoin. As these large-scale players enter the market, they bring significant capital, which can cause rapid price movements. Positive sentiment surrounding future Bitcoin ETF approvals and increased adoption of digital assets has also fueled bullish momentum.

- Macroeconomic Factors: Global economic trends, including inflation concerns and central bank policies, continue to impact the cryptocurrency market. Many investors view Bitcoin as a hedge against inflation, driving demand in times of economic uncertainty. Recent actions by the Federal Reserve and other central banks may have contributed to the renewed interest in crypto assets.

- Technical Analysis and Market Cycles: Market analysts often point to key technical levels and historical price patterns to predict movements in the cryptocurrency market. The recent bullish trend has been supported by technical factors, as Bitcoin broke through critical resistance levels, triggering stop-loss orders and liquidations of bearish positions.

Implications for the Crypto Market: What Comes Next?

The recent liquidation event highlights the ongoing volatility in the cryptocurrency market. While $165 million in liquidations might seem like a large sum, the crypto market is no stranger to such fluctuations. These liquidation events often serve as a reset, clearing out over-leveraged positions and setting the stage for more sustainable growth.

As the bulls regain control, the question remains: can they maintain this momentum?

- Bitcoin and other leading cryptocurrencies have seen strong upward momentum, but market participants should remain cautious. The volatility that led to this liquidation event could easily swing the other way if market conditions change.

- Institutional Adoption: Increased interest from institutional investors, including the possibility of a Bitcoin ETF approval, is likely to provide a tailwind for the crypto market in the coming months.

- Economic Indicators: Traders and investors will continue to monitor macroeconomic trends, particularly actions by central banks, inflation data, and global geopolitical events that could influence market sentiment.

Final Thoughts: Navigating Volatility

The recent liquidation wave is a reminder of the inherent risks in cryptocurrency trading, particularly for those using high leverage. While the market is showing signs of recovery, traders should exercise caution and ensure they manage their risk appropriately.

As the bulls take charge, it’s essential to stay informed about market developments and use strategies that protect against downside risk. In the volatile world of cryptocurrency, the only certainty is uncertainty—but with that uncertainty comes opportunity.

Whether you’re a seasoned trader or a new investor, navigating the ups and downs of the crypto market requires a balanced approach. With $165 million in liquidations behind us, the market is set for another chapter—are you ready?

For real-time updates and in-depth analysis, follow Kenya Crypto Magazine on Instagram here, X (Twitter) here, or join our WhatsApp group here for all things crypto!

ENG WANJIKU

Views: 18