The Argument for Bitcoin’s Value

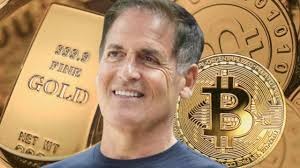

Cuban’s statement aligns with a growing sentiment among investors who view Bitcoin as a digital alternative to traditional safe-haven assets like gold. As economic uncertainties loom, Bitcoin’s decentralized nature and scarcity make it an attractive option for preserving wealth. Unlike gold, Bitcoin is not subject to the physical constraints of mining or transportation, nor is it reliant on centralized systems for validation or storage.

Why Not Gold?

Gold has long been considered a reliable store of value during turbulent economic times. Its history, tangibility, and universal acceptance have cemented its role as a hedge against inflation and market volatility. However, Cuban’s preference for Bitcoin suggests a shift in how modern investors perceive value. He points to the digital economy’s evolution and the increasing adoption of cryptocurrencies as factors that could eventually outshine gold’s historical dominance.

Bitcoin: A Hedge for the Digital Age

Bitcoin’s finite supply, capped at 21 million coins, is one of its most compelling features. This scarcity, combined with its transparency and immutability via blockchain technology, creates a unique value proposition. Moreover, Bitcoin’s portability and ease of transfer make it a versatile asset, particularly in a globalized, tech-driven world.

A Broader Trend Among Billionaires

Cuban is not alone in his endorsement of Bitcoin. Several high-profile investors, including Elon Musk and Michael Saylor, have also highlighted Bitcoin’s potential as a store of value. While opinions vary on the extent to which Bitcoin can replace traditional assets, the trend is indicative of a broader shift towards digital assets in portfolio diversification strategies.

Risks and Considerations

While Cuban’s confidence in Bitcoin is noteworthy, it is essential to recognize the risks associated with cryptocurrency investments. Bitcoin’s price volatility, regulatory uncertainties, and technological complexities remain barriers for some investors. However, for those who understand these dynamics, Bitcoin offers an innovative and potentially lucrative alternative to gold.

Conclusion

Mark Cuban’s statement underscores the growing relevance of Bitcoin in the modern financial landscape. As the world grapples with economic challenges, the debate between traditional and digital assets is becoming more pronounced. Whether Bitcoin will eventually supplant gold as the ultimate safe haven remains to be seen, but Cuban’s remarks certainly add weight to the conversation.

Connect with Kenya Crypto Magazine

Stay updated on the latest in crypto and blockchain by following us on our socials:

- Twitter: Kenya Crypto Magazine on Twitter

- Instagram: Kenya Crypto Magazine on Instagram

- WhatsApp: Join Our WhatsApp Group

Explore, learn, and grow with Kenya Crypto Magazine!

ENG WANJIKU

Views: 3