The crypto market is buzzing with predictions as Arthur Hayes, the co-founder of BitMEX, shares his outlook for Bitcoin and the broader crypto landscape in early 2025. Hayes envisions a strong rally fueled by U.S. dollar liquidity, pro-business policies, and a potential “Trump pump,” but warns of a significant market correction post-Q1 2025. Here’s a closer look at his forecast and the factors driving his analysis.

Q1 2025: A Crypto Market Boom in the Making?

Arthur Hayes predicts a robust surge in Bitcoin and the crypto market through the first quarter of 2025. His analysis hinges on a combination of liquidity injections and policy dynamics tied to Donald Trump’s anticipated presidency.

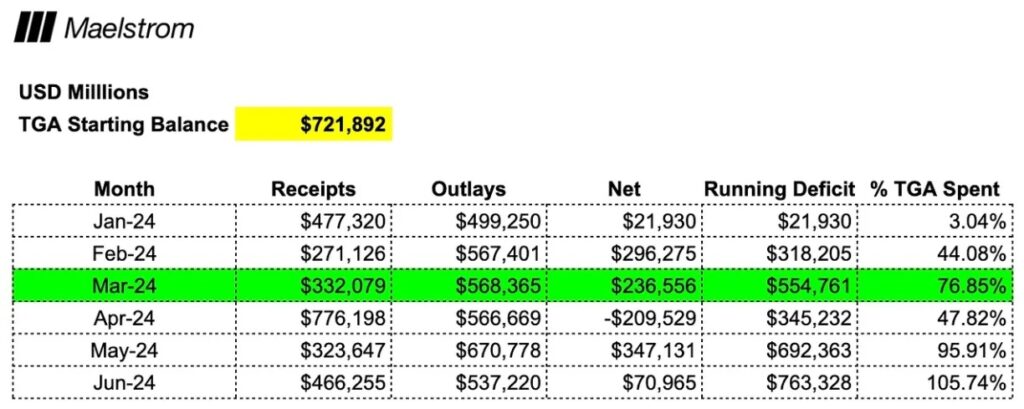

Trump’s administration is expected to adopt pro-business and pro-crypto policies, furthering market optimism. Additionally, Hayes highlights that U.S. Treasury actions, specifically liquidity injections via its General Treasury Account (TGA), could act as a powerful catalyst.

Hayes anticipates a net injection of $612 billion in U.S. dollar liquidity by the end of March 2025. This liquidity boost is predicted to amplify Bitcoin’s current bullish momentum, potentially driving it to new all-time highs beyond $102,000.

The Role of Liquidity and Market Dynamics

Hayes attributes much of the potential rally to shifts in U.S. dollar liquidity. He points to historical trends, such as the market’s response to the Federal Reserve’s Reverse Repo Facility (RRP) adjustments in 2022, as evidence of how liquidity impacts Bitcoin’s trajectory.

However, the Federal Reserve’s ongoing quantitative tightening (QT) measures—at $60 billion per month—are expected to reduce overall liquidity in the financial system. Despite this, Hayes believes the Treasury’s strategic spending, particularly if the debt ceiling is raised, will counterbalance the Fed’s tightening policies.

This delicate interplay of liquidity injections and fiscal decisions sets the stage for a highly bullish Q1 2025. Hayes advises investors to maintain a bullish stance during this period.

A Sharp Correction Looms Post-Q1 2025

While the outlook for Q1 2025 is optimistic, Hayes warns of a potential market correction following this peak. Tightening liquidity conditions and fading optimism from the “Trump pump” could dampen the rally’s momentum.

Key factors contributing to this anticipated correction include:

- Fiscal and Monetary Tightening: Both fiscal and monetary supports are expected to weaken post-Q1 2025, reducing market liquidity.

- Tax Season: With mid-April tax deadlines, a liquidity squeeze could emerge as the Treasury depletes its TGA.

- Historical Patterns: Hayes draws parallels with Bitcoin’s mid-2024 performance when the asset peaked at $73,000 in March before entering a prolonged correction in April.

Investors should brace for a corrective phase that may mirror or exceed previous pullbacks in magnitude.

Maelstrom’s Next Move: Betting on DeSci Projects

Looking beyond Bitcoin’s price action, Hayes revealed his firm, Maelstrom, is adopting a “DEGEN mode” strategy. This involves investing in decentralized science (DeSci) projects, an emerging sector focused on leveraging blockchain for scientific innovation.

Tokens such as BIO, VITA, ATH, GROW, PSY, CRYO, and NEURON are on Maelstrom’s radar. According to Hayes, DeSci represents a new frontier in blockchain applications, offering opportunities for investors seeking growth beyond traditional crypto assets.

Bitcoin’s Current Strength

As of now, Bitcoin is showing remarkable strength, trading above $102,000 and posting weekly gains of over 10%. Open interest in Bitcoin futures has also increased, reflecting growing optimism among traders. This sets a solid foundation for the anticipated rally heading into Q1 2025.

Final Thoughts

Arthur Hayes’ predictions paint an exciting but cautionary picture for Bitcoin and the crypto market in early 2025. While a rally to unprecedented heights seems likely, investors must remain vigilant for a sharp correction that could follow.

Stay connected with Kenya Crypto Magazine for more insights, strategies, and updates:

- Twitter: @_KenyaCryptoMag

- Instagram: KenyaCryptoMag

- WhatsApp: Join Our Community

Empowering Kenya, one crypto conversation at a time! 🚀

ENG WANJIKU

Views: 48