On October 23, 2024, a pivotal event took place at the iHit Center in Kilimani, Nairobi—the Digital Asset Tax Roundtable. This roundtable was organized by Chasing Mavericks, the Virtual Asset Chamber of Commerce, and the Kenya Blockchain & Crypto Conference. The primary focus was Kenya’s new 3% digital asset tax, which was introduced on September 1, 2023. The tax has since become a hot topic of discussion within the burgeoning crypto ecosystem, and this event provided a platform for industry players to engage directly with the Kenya Revenue Authority (KRA) on the matter.

The event brought together a wide array of attendees, including crypto developers, Web3 professionals, legal experts, and leaders of crypto exchanges and startups. The goal was to gain clarity on the tax policy’s implications, compliance strategies, and to discuss the broader challenges facing the industry as it navigates Kenya’s evolving regulatory framework.

Introduction by Sheila Waswa: Setting the Stage for Crucial Discussions

The evening began at 6:30 PM with welcoming remarks from Sheila Waswa, CEO of Chasing Mavericks. She encouraged attendees to network and engage with one another, emphasizing the importance of collaboration and knowledge-sharing within Kenya’s crypto industry. Sheila noted that collective efforts are crucial in shaping crypto regulations that are both business-friendly and in line with government objectives.

“As an industry, we must ensure that we engage openly with regulators like the KRA, bringing forth solutions that are viable not just for the government but also for businesses and individual traders,” Sheila remarked. This set the tone for what would be a deeply insightful and interactive session.

Keynote Presentation by S.A. Kakai: Challenges with the 3% Digital Asset Tax

The first in-depth presentation was delivered by S.A. Kakai, the Policy and Regulatory Engagement Lead for the Virtual Asset Chamber of Commerce. Kakai delved into the complexities of the 3% digital asset tax, particularly its impact on crypto exchanges and users.

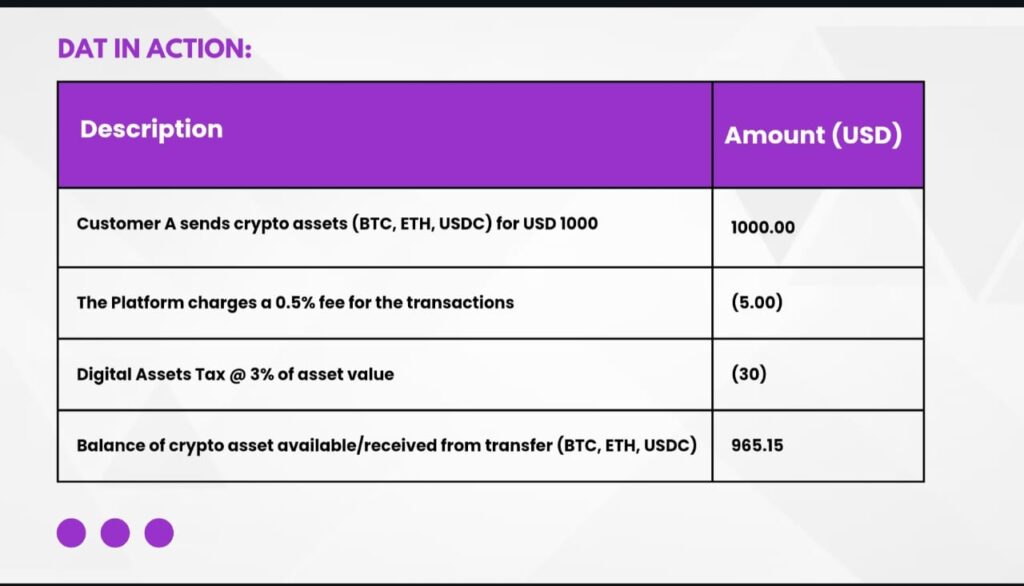

He explained how the tax applies to digital transactions, using Kakai’s Exchange as an example. When a user transfers $1,000 USDC through Kakai’s Exchange, a $30 tax is deducted, in addition to Kakai’s Exchange own 0.5% transaction fee. This means that users are incurring significant costs for every transaction.

Kakai emphasized the significant administrative burden that the new 3% digital asset tax places on crypto exchanges, which are now legally required to act as withholding agents. This means that exchanges must not only collect the tax on behalf of the government but also accurately calculate, report, and remit it for every transaction that occurs on their platforms.

To illustrate this, let’s consider the example of Kakai’s Exchange, one of the world’s largest cryptocurrency exchanges. When a user transfers $1,000 in a stablecoin like USDC or trades between cryptocurrencies like Bitcoin (BTC) and Ethereum (ETH), Kakai’s Exchange is now responsible for automatically deducting 3% of the transaction’s value to cover the tax. In this case, $30 would be withheld from the user’s transfer, in addition to Kakai’s Exchange own transaction fee (which might be around 0.5%). This results in a combined charge of $35 for the user, with $30 going to the Kenya Revenue Authority (KRA) and the remaining amount to Kakai’s Exchange.

However, the complexity doesn’t end with simple transfers or trades. Exchanges also need to track and tax more intricate transaction types, such as peer-to-peer (P2P) transactions, swapping one cryptocurrency for another, and cross-border transfers. For example, if a user in Kenya swaps Bitcoin for Ethereum, the exchange must ensure that 3% of the value of that swap is deducted and reported to KRA as a taxable transaction.

Without automated systems in place, the process of calculating these taxes manually for potentially thousands of transactions per day becomes overwhelmingly complicated for exchanges. Imagine Binance handling millions of dollars in trades each day from Kenyan users. The platform would have to maintain detailed records for each transaction, ensuring the correct tax amounts are deducted, filed, and remitted to KRA within the stipulated timeframe (typically five days after the transaction).

KRA representative, Mr Omondi stressed that this is why automation is critical. By integrating API systems (Application Programming Interfaces), exchanges can automatically compute the 3% tax at the point of transaction, generate real-time reports for tax filings, and handle the remittance process seamlessly. This minimizes errors, reduces the administrative workload, and ensures that exchanges comply with the tax law without overburdening their operations.

For instance, if a crypto exchange does not automate these processes, their compliance teams would have to manually track every single user transaction, calculate the tax, prepare reports, and manually remit the collected taxes to the KRA—likely leading to inefficiencies, delays, and even potential penalties for late or incorrect reporting.

KRA’s proposed API system could offer a solution by integrating directly with exchanges, automating tax collection, filing, and payment, and thus, making the compliance process smoother for platforms like Binance, KuCoin, or any other exchange operating in Kenya. However, until this system is in place, the current manual burden presents a significant challenge for crypto platforms, particularly smaller exchanges that might not have the resources to handle such an administrative load.

KRA’s Perspective: Insights from Nixon Omondi

Following Kakai’s detailed presentation, Nixon Omondi, the Manager of the Digital Economy Tax Office at the Kenya Revenue Authority (KRA), took the stage to outline KRA’s official position on the newly implemented 3% digital asset tax. Omondi acknowledged the rapidly growing role of digital assets, such as cryptocurrencies, stablecoins, and NFTs, in Kenya’s evolving digital economy. He underscored how this burgeoning sector has created a need for clear regulations and tax frameworks, which led to the introduction of this new tax in the Finance Act of 2023.

Kenya’s Foray into Digital Taxation: Laying the Groundwork

Omondi began by recounting Kenya’s initial steps into digital taxation, which began with the introduction of the Digital Service Tax (DST) in January 2021. The DST was designed to tax non-resident digital service providers, such as Netflix and Uber, who earned revenue from Kenyan users but were not physically based in Kenya. The DST, initially set at 1.5% of gross transaction value, was later revised to focus on service entities, thereby excluding broader digital activities such as cryptocurrency transactions.

However, Omondi explained that the fast-paced growth of digital assets and blockchain technologies in Kenya, along with increased adoption of cryptocurrencies for everything from remittances to peer-to-peer trading, prompted the government to look more closely at the sector. This scrutiny culminated in the Finance Act of 2023, which introduced the 3% digital asset tax aimed at cryptocurrency transactions and other digital asset exchanges.

How the 3% Digital Asset Tax Works

Omondi emphasized that under this law, crypto exchanges operating in Kenya are required to act as withholding agents for the tax. This means that platforms such as Binance, KuCoin, and other local exchanges are legally obligated to collect the 3% tax on behalf of the government and remit it to the KRA within a specified time frame—typically five days after the transaction occurs.

For example, when a Kenyan user trades Bitcoin (BTC) for Ethereum (ETH) on an exchange, the platform must automatically withhold 3% of the value of that transaction as tax. So, if a user swaps $1,000 worth of Bitcoin for Ethereum, the exchange would deduct $30 for tax, in addition to any platform fees that it charges for the transaction.

This poses an administrative challenge for exchanges, especially given the volume and complexity of crypto transactions, many of which include high-frequency trading, peer-to-peer (P2P) trades, and even cross-border crypto remittances. Omondi acknowledged that enforcing this tax policy across a highly dynamic and decentralized sector would not be straightforward, which is why the KRA is actively developing API systems to help exchanges automate the process.

The Challenge of Fiat Payments in a Crypto Economy

One of the most contentious issues raised during Omondi’s presentation was the question of whether the KRA would accept tax payments in cryptocurrencies like Bitcoin or stablecoins such as USDC or Tether (USDT). In Kenya, as in most countries, the legal framework mandates that taxes be paid in the national fiat currency, the Kenyan shilling (KES). However, this presents a unique challenge in the context of cryptocurrency taxation, as many crypto transactions occur in digital currencies, and the industry itself is largely built on the idea of decentralized, borderless money.

For example, when a user makes a crypto-to-crypto swap on a platform like Binance, they may not have any immediate interaction with fiat currency. If an individual in Kenya swaps Ethereum for Solana (SOL), the value of that trade would be subject to the 3% tax, but the user might not necessarily have Kenyan shillings readily available to pay the tax. In such scenarios, the exchange would need to convert part of the transaction’s value into fiat to settle the tax liability—potentially complicating both the user experience and the exchange’s internal operations.

Omondi admitted that this was a gray area in the regulatory framework that the KRA was still reviewing. While the law currently requires taxes to be paid in fiat, Omondi hinted that this could change in the future as KRA explores ways to adapt to the unique demands of the cryptocurrency sector. “We are still in discussions on whether or not taxes in digital assets can be accepted,” Omondi said, “but for now, our legal framework mandates fiat payments.”

This is a significant challenge for exchanges like Binance and KuCoin, which would need to develop mechanisms to convert crypto transactions into Kenyan shillings in real-time to remit taxes. Omondi encouraged stakeholders to write to the Commissioner of KRA for private rulings if they encountered unique challenges related to compliance, suggesting that the authority is open to feedback and willing to address specific cases on a more individualized basis.

Complex Transactions and the Future of Crypto Taxation

Omondi also fielded several questions related to complex crypto transactions. For instance, cross-border remittances in cryptocurrency, a popular use case for digital assets in Kenya, would also be subject to the 3% tax. This raised concerns among participants, particularly regarding how such transactions would be monitored and taxed when they involve multiple jurisdictions or when the value is transferred across different types of cryptocurrencies.

One example cited involved Kenyan freelancers who are paid in cryptocurrencies by international clients. Such transactions often occur entirely outside traditional financial systems, yet they would still fall under the scope of the digital asset tax once the crypto is exchanged for goods, services, or even other cryptocurrencies.

The discussion brought to light some of the broader technical and regulatory challenges Kenya faces as it seeks to tax a decentralized and often anonymous digital economy. Omondi emphasized that the KRA is committed to working with industry stakeholders to develop a balanced and fair regulatory framework, but admitted that it would take time to fully understand and integrate the unique aspects of the crypto ecosystem into Kenya’s tax system.

The Road Ahead

Omondi concluded by reaffirming the KRA’s commitment to embracing digital innovations while ensuring that they align with the country’s tax policies. The introduction of the 3% digital asset tax is just the first step, but the KRA recognizes that the industry will require ongoing dialogue and refinement of the legal framework.

He reiterated that while the KRA is actively working on API integrations to help streamline compliance, exchanges should continue engaging with the authority to navigate the evolving regulatory landscape. With further discussions planned between the KRA, Central Bank of Kenya (CBK), and the Capital Markets Authority (CMA), Omondi highlighted that the tax regime is expected to evolve in response to new developments in the crypto space, ensuring that Kenya remains competitive while safeguarding government revenues.

In the meantime, he encouraged stakeholders to take advantage of private rulings for any unique tax situations, and invited further collaboration to help define the future of Kenya’s digital asset taxation policy.

Q&A Session: Navigating the Complexities of Crypto Taxation in Kenya

During the roundtable discussion, a series of questions were raised by participants, including crypto exchange operators, industry leaders, and regulators. The session delved into some of the practical challenges and concerns surrounding the implementation of the 3% digital asset tax, which is set to transform how crypto businesses operate in Kenya.

Q: Have exchanges successfully implemented the 3% tax?

A: Nixon Omondi admitted that compliance with the 3% digital asset tax is still in its early stages. While the KRA is making strides to assist exchanges, the process has not been without its challenges. Many exchanges, both local and international, are grappling with the technical and administrative requirements needed to ensure proper withholding and remittance of taxes. Omondi urged crypto platforms to maintain close communication with the KRA to address any specific hurdles they encounter during implementation. He further emphasized that KRA is open to receiving feedback and making adjustments where necessary.

Q: Should all digital assets be taxed equally?

A: This question highlighted the concern around treating different types of digital assets, such as stablecoins and speculative tokens, equally under the current tax framework. Participants argued that stablecoins like USDC and Tether (USDT), which are primarily used for transactions and remittances, should not be taxed in the same way as more volatile assets like Bitcoin or Ethereum, which are often held for investment purposes. Omondi responded by noting that, for now, all digital assets are treated equally under the law. However, he acknowledged that this is an area for potential revision as more clarity emerges from ongoing deliberations within the KRA and other regulatory bodies.

Q: Are crypto swaps taxable?

A: The issue of crypto swaps sparked a lot of discussion. When asked whether exchanging one cryptocurrency for another (e.g., swapping Bitcoin for Ethereum) would be subject to the 3% tax, Omondi confirmed that such transactions are indeed taxable. This means that whether a trader is cashing out into fiat or merely swapping one crypto asset for another, the transaction is seen as taxable by the KRA. This raised concerns from traders who often swap digital assets as part of their portfolio management strategies, not necessarily for profit-making purposes. Omondi’s confirmation solidified that any transfer of value, whether through a fiat conversion or crypto-to-crypto swap, is subject to the tax.

Q: Why is there a capital gains tax exemption for crypto but still a 3% digital asset tax?

A: One participant raised the issue of capital gains tax, which exempts crypto and shares in Kenya. Omondi explained that while capital gains tax exempts cryptocurrencies, the Finance Act of 2023 introduced the 3% digital asset tax as an alternative means of taxing the crypto space. The digital asset tax operates on the assumption that profit is being made in every transaction, whether it’s speculative or not, which is why exchanges are mandated to withhold 3% from the transaction value and remit it to the government within five days.

Q: What are the steps being taken to ensure compliance through API integration?

A: Omondi emphasized the importance of API integrations between the KRA and crypto exchanges to streamline the tax remittance process. These APIs are designed to automate the deduction and transfer of the 3% tax directly from the transaction to the government, minimizing manual interventions. However, exchanges raised concerns about the readiness of these systems and the potential technical challenges. For example, in real-time transactions where millions of trades occur per day, platforms need sophisticated technology to ensure seamless compliance. The KRA is actively working with developers and tech specialists to address these concerns, but full implementation is still a work in progress.

Q: Can the KRA receive tax payments in cryptocurrency?

A: A particularly contentious question revolved around the possibility of paying taxes in cryptocurrencies rather than in Kenyan shillings (KES). Omondi reiterated that the current legal framework in Kenya requires all tax payments to be made in fiat. This presents a significant challenge for crypto exchanges and users, as transactions on platforms like Binance or KuCoin typically occur in digital currencies. As such, the exchanges would be responsible for converting cryptocurrency into fiat to settle the tax liability. This requirement places an additional burden on the platforms, as they would need to build systems capable of real-time currency conversions. While Omondi acknowledged the complexity of this issue, he indicated that it remains a gray area in the regulatory framework and could be revisited in the future.

Q: Is there a tax when facilitating payment of the 3% tax in fiat?

A: One participant asked whether an additional tax is applied when converting crypto into fiat to pay the 3% digital asset tax. Omondi clarified that there is no “tax on tax”. Once the 3% is withheld, there should be no further tax applied when converting the withheld amount into fiat for remittance to the KRA.

Q: How does KRA treat complex transactions like stablecoins or cross-border remittances?

A: Another point of concern was whether stablecoins, such as USDC or USDT, and cross-border remittances would be taxed in the same way as speculative or investment-driven crypto transactions. Omondi reiterated that for now, the law does not distinguish between different types of digital assets—stablecoins, volatile cryptocurrencies, and other tokens are all treated equally. However, participants argued that stablecoins are often used for cross-border payments due to their speed and low transaction fees, not for speculation. Omondi indicated that while this is an important consideration, the current law covers all transactions under the 3% tax. He suggested that industry stakeholders write to the KRA Commissioner to request private rulings in cases of complex or unique transactions.

Q: Should the government gain a better understanding of the crypto space before rushing into taxation?

A: Several participants expressed concerns that the government may not fully understand the intricacies of the crypto space, which could lead to poorly designed tax policies. Some felt that KRA should invest more time in learning how cryptocurrencies, tokens, and blockchain technology work before finalizing taxation strategies. Omondi acknowledged these concerns and pointed out that the KRA is actively working with technology experts and developers to ensure the taxation framework is practical and adaptable. He encouraged further dialogue between the government and the crypto community to ensure policies are informed and effective.

Q: Will there be a categorization of digital assets for tax purposes?

A: Participants questioned whether the KRA could implement a categorization system that distinguishes between different types of digital assets—such as speculative tokens, non-appreciating stablecoins, and utility tokens—and apply varying tax rates accordingly. Omondi admitted that while the current system does not differentiate, future discussions and regulations might consider a more nuanced approach, particularly as the KRA continues to gain a deeper understanding of the different roles digital assets play in the economy.

Q: How do banks and licenses factor into the taxation issue?

A: The issue of banks not allowing accounts registered under crypto businesses was another major concern raised during the session. Some participants questioned how they could pay taxes if their businesses were not legally acknowledged by local financial institutions. Omondi recognized that this was a significant gray area and mentioned that there are ongoing discussions around how the Central Bank of Kenya (CBK) and the Capital Markets Authority (CMA) can offer a clearer framework for licensing and regulating crypto businesses. Until then, exchanges and businesses would need to navigate the challenges of operating in an environment with limited institutional support.

Final Remarks by S.A. Kakai and Networking Opportunities

In his final remarks, S.A. Kakai, representing the Virtual Asset Chamber of Commerce (VACC), provided a succinct summary of the day’s extensive discussions. He thanked the participants for their insightful questions and contributions, emphasizing the importance of collaborative efforts in shaping Kenya’s emerging crypto tax framework. Kakai acknowledged the concerns raised, particularly the challenges facing exchanges and the ambiguities surrounding stablecoins, cross-border remittances, and crypto-to-crypto swaps. He promised to escalate these key concerns to the relevant regulatory bodies, including the Central Bank of Kenya (CBK) and the Capital Markets Authority (CMA), for further review and potential amendments to the existing regulations. Kakai also urged participants to remain engaged with ongoing developments, assuring them that the KRA is open to continued dialogue and consultation as the industry evolves.

Closing Remarks by Sheila Waswa and Networking Opportunities Over Refreshments And Snacks.

Following Kakai’s address, Sheila Waswa, the moderator and representative of the, Chasing Mavericks, brought the formal proceedings to a close. She took a moment to commend the attendees for their active participation, noting how vital it is to maintain an open line of communication between crypto industry players and regulators. Waswa reiterated that the success of Kenya’s digital asset space depends on a collaborative environment, where regulators and innovators work hand-in-hand to create policies that are not only enforceable but also conducive to the industry’s growth.

In a move to extend the day’s conversations beyond the physical event, Waswa invited all attendees to join the Virtual Asset Chamber of Commerce’s WhatsApp group, Click here to join, a platform designed for continuous discussions, updates, and collaboration. “This isn’t the end of the conversation; it’s just the beginning,” she said, encouraging participants to stay active in shaping the future of crypto regulation in Kenya. She expressed hope that the chamber would serve as a central hub for connecting industry leaders, regulators, and legal experts, fostering a space where ideas can be exchanged and concerns raised.

Sheila’s remarks set the tone for the event’s final segment—an informal networking session that allowed participants to interact with one another on a more personal level. The session took place in the venue’s garden, where attendees enjoyed a variety of refreshments, including tea, coffee, fresh juices, and an assortment of pastries and snacks. The relaxed setting provided an excellent opportunity for attendees to discuss the day’s topics more freely and build valuable professional relationships.

Many attendees took advantage of the opportunity to connect with key figures in Kenya’s crypto industry, such as exchange operators, regulatory representatives, and tech developers. Conversations flowed easily, with topics ranging from technical aspects of API integrations for tax compliance to the broader implications of Kenya’s digital asset regulations. Some participants discussed potential partnership opportunities, while others exchanged contact information to collaborate on future crypto-related projects.

The networking session also saw representatives from global exchanges like Binance and KuCoin engaging in in-depth discussions with local developers and legal experts. They explored how their platforms could better integrate with Kenya’s emerging regulatory requirements while maintaining operational efficiency. There was a palpable sense of optimism as industry players expressed their commitment to staying in Kenya despite the regulatory challenges, believing that the country’s vibrant crypto community has the potential to thrive with the right frameworks in place.

Sheila Waswa herself moved through the crowd, facilitating introductions between attendees and encouraging open dialogue. She highlighted the importance of such networking opportunities in fostering long-term partnerships and collaborations that would ultimately benefit the entire crypto ecosystem. By the time the session concluded, several attendees had laid the groundwork for potential partnerships, and the WhatsApp group had already gained new members eager to continue the conversation.

As the evening drew to a close, it was evident that the informal networking session had been a valuable extension of the formal discussions. Attendees left not only with a deeper understanding of Kenya’s evolving crypto tax landscape but also with new connections and a shared commitment to shaping the future of the industry.

Kenya Crypto Magazine as a Media Partner

The Digital Asset Tax Roundtable was well covered by several media outlets, including Kenya Crypto Magazine, which was invited by Chasing Mavericks to represent the event as a media house. As a leading publication in Kenya’s crypto space, Kenya Crypto Magazine offers in-depth coverage of the country’s blockchain ecosystem, with a focus on events, industry analysis, and regulatory developments. Their presence at the roundtable allowed them to share the insights and outcomes of the event with the broader Kenyan crypto community.

Other media houses in attendance included Block Wisely and ChainTum Research:

- Block Wisely, a Substack publication, provides analytical insights into blockchain technology and the crypto market, catering to both beginners and experts.

- ChainTum Research focuses on research-driven content, exploring blockchain use cases, market trends, and policy analysis to inform both policymakers and the public.

Together, these media outlets help foster an informed crypto community in Kenya, sharing the narratives and challenges that shape the industry.

Chasing Mavericks: The Event Organizers

The event was organized by Chasing Mavericks, a premier PR and Communications Agency in Kenya. Known for their work in elevating brands and startups, Chasing Mavericks has established itself as a leader in crafting impactful brand narratives in the tech and innovation sectors. Their mission is to strategically communicate and elevate businesses to new heights, with a vision of becoming Kenya’s leading innovation corporate communication agency.

By organizing the Digital Asset Tax Roundtable, Chasing Mavericks demonstrated their ability to bring together key stakeholders to address critical issues affecting the future of Kenya’s crypto industry.

View highlights and photos from the event here.

For further inquiries or to participate in future discussions, please contact:

Join the VIRTUAL ASSETS CHAMBER WHATSAPP GROUP HERE

Also, Kenya Crypto Magazine highlights upcoming events before they happen and provide insightful coverage of what unfolds, ensuring you stay informed about Kenya’s rapidly evolving crypto ecosystem.

Instagram: @KenyaCryptoMag

WhatsApp : Join our whatsapp group

Website: kenyacryptomagazine.com

Twitter: @KenyaCryptoMag

ENG WANJIKU

Views: 236