Bitcoin (BTC) has established itself as a revolutionary digital asset, with individuals, governments, and institutions amassing significant quantities of the cryptocurrency. While Bitcoin’s decentralized nature ensures that no single entity controls the network, certain holders have accumulated vast amounts of BTC, giving them substantial influence in the market. These top Bitcoin holders range from early adopters and tech companies to governments and asset managers, all of whom have a unique role in shaping Bitcoin’s trajectory.

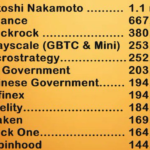

Here’s a closer look at the top 12 Bitcoin holders, highlighting just how much of the flagship crypto they control.

1. Satoshi Nakamoto (1.1 Million BTC)

The enigmatic creator of Bitcoin, Satoshi Nakamoto, is still the largest holder of Bitcoin, with an estimated 1.1 million BTC. These coins were mined during the early days of Bitcoin, and none have been moved, adding to the intrigue surrounding Nakamoto’s identity. With a value of over $37 billion today, Nakamoto’s holdings could potentially reshape the market if ever sold or distributed.

2. Binance (667,345 BTC)

Binance, the world’s largest cryptocurrency exchange, holds a staggering 667,345 BTC. These holdings include both company reserves and customer assets stored in the exchange’s wallets. Binance’s vast Bitcoin holdings make it a central player in global liquidity and price movements.

3. BlackRock (380,985 BTC)

BlackRock, the largest asset manager in the world, has been steadily increasing its Bitcoin holdings through its Spot Bitcoin ETFs and other crypto investment vehicles. With 380,985 BTC, BlackRock is positioning itself as a dominant force in the crypto market, with growing institutional and retail investor interest in its products.

4. Grayscale Bitcoin Trust (253,821 BTC)

Grayscale’s Bitcoin Trust (GBTC) remains one of the most popular ways for institutional investors to gain exposure to Bitcoin without directly holding the asset. Grayscale currently holds 253,821 BTC, worth over $8.7 billion. As the largest institutional Bitcoin holder, Grayscale plays a significant role in influencing the institutional adoption of Bitcoin.

5. MicroStrategy (252,220 BTC)

MicroStrategy, under the leadership of CEO Michael Saylor, has converted most of its cash reserves into Bitcoin. The company now holds 252,220 BTC, making it one of the largest corporate holders of Bitcoin. Saylor’s belief in Bitcoin as a store of value has made MicroStrategy a key advocate for BTC adoption by businesses.

6. The U.S. Government (203,239 BTC)

Through various seizures, notably from criminal activities such as the Silk Road marketplace, the U.S. government has accumulated 203,239 BTC. While some of these Bitcoin holdings have been auctioned off, a significant portion remains with the government. With growing conversations around adopting a national Bitcoin reserve strategy, the U.S. government’s role in Bitcoin’s future could be crucial.

7. Bitfinex (194,937 BTC)

Bitfinex, one of the largest cryptocurrency exchanges, holds 194,937 BTC in its reserves. Bitfinex’s position in the market gives it substantial influence over Bitcoin liquidity, and its security practices have been under scrutiny given the history of exchange hacks in the industry.

8. Chinese Government (194,000 BTC)

Despite China’s strict crackdown on cryptocurrency trading and mining, the Chinese government holds 194,000 BTC. These coins were mostly seized from illegal operations, including Ponzi schemes. The future of these holdings remains unclear, but they place China among the top BTC holders globally.

9. Fidelity (184,438 BTC)

Fidelity, a global financial services giant, has made significant strides in the crypto space, with 184,438 BTC under its management. Fidelity’s involvement in Bitcoin through its various investment products, including custody services, has opened the door for more institutional investors to enter the crypto market.

10. Kraken (169,583 BTC)

Kraken, another prominent cryptocurrency exchange, holds 169,583 BTC. As one of the oldest and most trusted platforms, Kraken’s Bitcoin reserves solidify its place as a major player in the crypto trading space. Kraken has been instrumental in driving mainstream adoption of Bitcoin through its global user base.

11. Block.one (164,000 BTC)

Block.one, the blockchain software company behind EOS, holds 164,000 BTC. The company’s Bitcoin reserves are part of its strategy to maintain a diversified crypto portfolio. Block.one’s holdings underscore its long-term belief in Bitcoin as a major asset.

12. Robinhood (144,452 BTC)

Robinhood, the popular trading app, holds 144,452 BTC. Robinhood has made Bitcoin and other cryptocurrencies accessible to a wider audience of retail investors. With its significant Bitcoin holdings, Robinhood’s role in the crypto market has expanded rapidly since it began offering crypto trading in 2018.

Conclusion: The Power of Bitcoin’s Top Holders

The combined holdings of these top 12 Bitcoin holders amount to millions of BTC, worth billions of dollars. From early adopters and exchanges to governments and financial institutions, these entities play a pivotal role in shaping the future of Bitcoin and the broader cryptocurrency market. As Bitcoin continues to mature and more institutions adopt it, the influence of these major holders will only grow.

Whether through institutional adoption, government policy, or market activity, the moves made by these Bitcoin titans will impact the price and long-term success of the world’s first cryptocurrency.

Stay connected with the latest crypto insights from Kenya Crypto Magazine:

- Twitter: @_KenyaCryptoMag

- Instagram: @KenyaCryptoMag

- WhatsApp: Join our WhatsApp

QUEEN WHALE

Views: 12