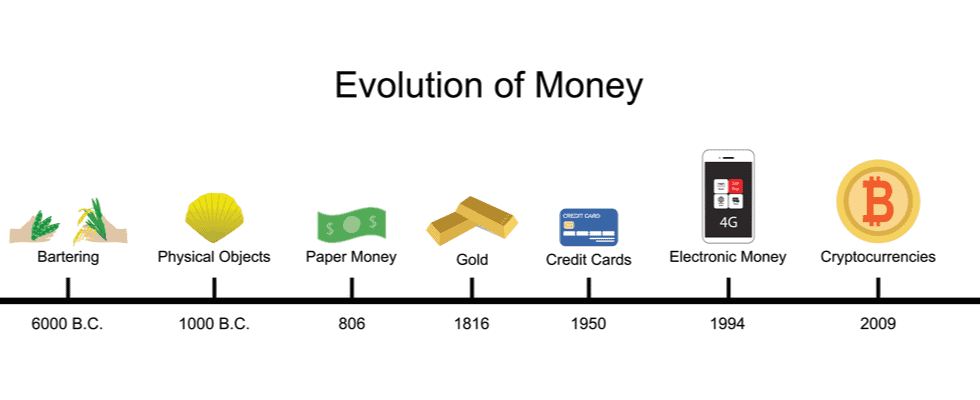

As the world continues to embrace digital transformation, cryptocurrencies have emerged as a revolutionary force in the financial landscape. This blog post explores the key features, advantages, disadvantages, and myths surrounding cryptocurrencies, providing a comprehensive guide for both beginners and seasoned enthusiasts.

Features of Cryptocurrencies

- Decentralization: Unlike traditional currencies, cryptocurrencies operate on decentralized networks, typically powered by blockchain technology. This means no single entity, not even governments, has control over them.

- Digital Assets: Cryptocurrencies exist solely in digital form, eliminating the need for physical money or intermediaries like banks.

- Security: Cryptographic techniques are used to secure transactions and control the creation of new units, ensuring the integrity and security of the network.

- Transparency: Most cryptocurrencies operate on public blockchains, making transaction histories accessible to anyone while maintaining the anonymity of the participants.

- Anonymity and Pseudonymity: While transactions are visible, the identities of those involved are represented by cryptographic addresses, offering a level of privacy.

- Global Accessibility: With an internet connection, anyone can access and use cryptocurrencies, regardless of location.

- 24/7 Availability: Cryptocurrency networks operate around the clock, allowing transactions to occur anytime, including weekends and holidays.

- Lower Transaction Fees: Compared to traditional financial systems, cryptocurrency transactions often have lower fees, especially for cross-border transfers.

Advantages of Cryptocurrencies

- Decentralization: Cryptocurrencies empower individuals by allowing them to manage their money without interference from governments or central banks.

- Ease of Setup: Setting up a cryptocurrency wallet is quick and straightforward, unlike the lengthy process of opening a bank account.

- Anonymity: Cryptocurrency transactions are private, with no one knowing how much is entering or leaving your wallet.

- Transparency: While transactions are public, the identities behind them remain hidden, ensuring privacy without sacrificing transparency.

- Low Transaction Fees: Cryptocurrencies like those on the TRON blockchain offer minimal transaction fees, often less than $0.50.

- Speed: Cryptocurrency transactions are almost instantaneous, taking seconds or minutes to reflect in destination addresses.

- Portability: Cryptocurrencies are not physical, making them easy to carry. You could hold billions in your digital wallet without anyone knowing.

- Permanent Transactions: Once a cryptocurrency transaction is made, it cannot be reversed, providing security against chargebacks common in traditional payment systems.

- Digital Ownership and Scarcity: Cryptocurrencies like Bitcoin have a fixed supply, creating digital scarcity and value over time.

Disadvantages of Cryptocurrencies

- Irretrievability: Cryptocurrency transactions are final and cannot be undone, so users must exercise caution when sending funds.

- Market Volatility: Cryptocurrencies are known for their extreme price volatility, with values fluctuating rapidly.

- Regulatory Uncertainty: The regulatory landscape for cryptocurrencies varies widely across jurisdictions, leading to potential legal challenges.

- Limited Acceptance: Many local businesses may not accept cryptocurrencies due to a lack of understanding, though this is gradually changing.

- Technical Skills Required: Using cryptocurrencies requires a certain level of technical knowledge, which can be a barrier for some people.

Myths and Misconceptions about Cryptocurrencies

- Crypto is Illegal: Cryptocurrencies are not illegal but rather unregulated in many areas. It’s important to understand the legal environment in your region.

- It’s a Scam: While some fraudulent schemes have used the name of cryptocurrency, the technology itself is legitimate. Always do your due diligence before investing.

- It’s a Fad: Cryptocurrencies are not a passing trend. With over a million cryptocurrencies in existence, they are here to stay.

- Bitcoin is the Only Cryptocurrency: Bitcoin may be the most well-known, but there are thousands of other cryptocurrencies available.

- Cash for Criminals: While some early associations with crime exist, the same could be said for cash. Cryptocurrency’s transparency makes it less appealing for illicit activities.

- Counterfeit Risk: Cryptocurrencies are not counterfeit due to the cryptographic processes that make them secure.

- Not Secure: There are numerous ways to secure your cryptocurrency holdings, from hardware wallets to multi-signature transactions.

- Complex Trading: Trading cryptocurrencies can be as straightforward as trading stocks, with many platforms available to help.

- Missed Opportunity: Even if you don’t have large sums to invest, you can buy fractions of cryptocurrencies.

- Anonymous Transactions: While many believe all crypto transactions are anonymous, most are traceable to a certain extent, especially on public blockchains like Bitcoin.

Cryptocurrencies continue to evolve, and understanding their features, benefits, and potential drawbacks is crucial for anyone looking to participate in the digital economy. As the industry grows, staying informed and cautious will be key to navigating this exciting financial frontier.

ENG WANJIKU

Views: 16