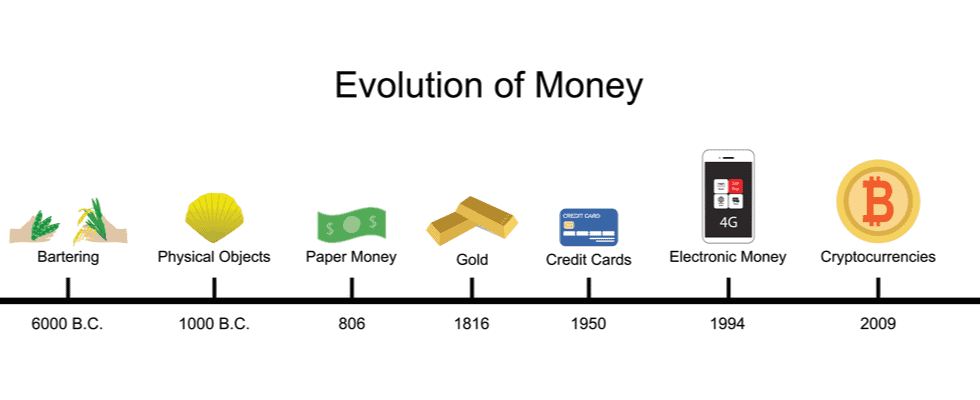

The cryptocurrency market has evolved significantly since the introduction of Bitcoin, with over 2 million cryptocurrencies now in existence. These digital assets can be categorized into various types, each serving different purposes and offering unique benefits. Let’s delve into the most prominent types of cryptocurrencies and explore their functions and examples.

1. Bitcoin (BTC)

Bitcoin is the first and most well-known cryptocurrency. Created by an unknown person or group of people under the pseudonym Satoshi Nakamoto in 2009, Bitcoin serves as a digital store of value and a medium of exchange. It is often referred to as “digital gold” due to its limited supply of 21 million coins and its role as a hedge against inflation. Bitcoin’s decentralized nature and widespread adoption have solidified its position as the leader in the cryptocurrency space.

2. Ethereum (ETH)

Ethereum is more than just a cryptocurrency; it’s a decentralized platform that enables developers to build and deploy smart contracts and decentralized applications (DApps). Launched in 2015 by Vitalik Buterin, Ethereum introduced the concept of programmable contracts, allowing for the automation of agreements without the need for intermediaries. Ethereum’s native currency, Ether (ETH), is used to fuel transactions and computational services on the network. Ethereum’s versatility has made it the foundation for numerous innovations, including DeFi (Decentralized Finance) and NFTs (Non-Fungible Tokens).

3. Stablecoins

Stablecoins are a class of cryptocurrencies that aim to provide price stability by being pegged to a reserve asset such as fiat currency (USD, EUR) or commodities like gold. They are designed to combine the benefits of digital assets with the stability of traditional currencies. Stablecoins are commonly used for trading, remittances, and as a medium of exchange within the crypto ecosystem.

Examples of Stablecoins:

- Tether (USDT): Pegged to the US dollar, Tether is one of the most widely used stablecoins.

- USD Coin (USDC): Another US dollar-pegged stablecoin, USDC is known for its transparency and compliance with regulations.

- Dai (DAI): A decentralized stablecoin that maintains its peg to the US dollar through an algorithmic system rather than relying on a central entity.

4. Utility Tokens

Utility tokens are cryptocurrencies that are designed to be used for specific purposes within a particular blockchain ecosystem. They are often used to access services, pay for transactions, or participate in network governance. Utility tokens play a vital role in the functionality of many blockchain platforms.

Example of Utility Tokens:

- Binance Coin (BNB): Originally created as a utility token for discounted trading fees on the Binance exchange, BNB has evolved to fuel the Binance Smart Chain (BSC) and is used for various applications within the Binance ecosystem.

5. Security Tokens

Security tokens represent ownership in real-world assets, such as company shares, real estate, or other investments. These tokens are subject to federal securities regulations and are designed to bring traditional financial assets onto the blockchain. Security tokens offer a way to tokenize and trade traditionally illiquid assets, providing greater access and liquidity.

Example of Security Tokens:

- tZERO: A security token exchange platform that facilitates the trading of digital securities, including tokenized assets like real estate and company equity.

6. Tokenized Assets

Tokenized assets are a type of security token that represent ownership in physical or digital assets such as real estate, art, or intellectual property. These tokens allow for fractional ownership and trading of assets that were previously difficult to divide or transfer.

Example of Tokenized Assets:

- RealT: A platform that allows investors to purchase fractional ownership in real estate properties through tokenization.

7. Exchange Tokens

Exchange tokens are native to cryptocurrency exchange platforms and often provide holders with benefits such as reduced trading fees, access to exclusive features, and participation in platform governance. These tokens are integral to the functioning of their respective exchanges.

Examples of Exchange Tokens:

- Binance Coin (BNB): Used on the Binance exchange for trading fee discounts and other benefits.

- FTX Token (FTT): The native token of the FTX exchange, offering benefits such as trading fee discounts and staking rewards.

- KuCoin Token (KCS): KuCoin’s native token that provides holders with a share of the exchange’s revenue and other perks.

8. DeFi Tokens

DeFi (Decentralized Finance) tokens are used within decentralized financial platforms to facilitate lending, borrowing, trading, and earning interest without the need for traditional financial intermediaries. These tokens often represent governance rights, allowing holders to vote on protocol changes and decisions.

Examples of DeFi Tokens:

- Uniswap (UNI): A decentralized exchange (DEX) token used for governance and liquidity provision on the Uniswap platform.

- Aave (AAVE): A DeFi token used for governance and as a collateral asset on the Aave lending platform.

9. Privacy Tokens

Privacy coins are cryptocurrencies designed to protect the anonymity of users and transactions. These tokens use advanced cryptographic techniques to obscure transaction details, making it difficult to trace the movement of funds on the blockchain.

Examples of Privacy Tokens:

- Monero (XMR): A privacy-focused cryptocurrency that uses ring signatures and stealth addresses to obfuscate transaction details.

- Zcash (ZEC): Offers optional privacy features that allow users to shield their transactions from public view.

10. Shitcoins

Shitcoins are cryptocurrencies that are perceived to have little or no value and often lack a clear purpose or utility. They are typically characterized by high volatility, low liquidity, and limited adoption. The term “shitcoin” is often used derogatorily to describe coins that are viewed as speculative or without long-term potential.

11. Meme Coins

Meme coins are a type of cryptocurrency that gains popularity due to its meme-like nature, humor, or viral appeal rather than its technical merits. These coins are often driven by community support and social media hype, leading to significant price volatility.

Examples of Meme Coins:

- Dogecoin (DOGE): Originally created as a joke, Dogecoin gained a massive following and became one of the most recognizable meme coins.

- Shiba Inu (SHIB): A token inspired by the Shiba Inu dog breed and marketed as the “Dogecoin killer.”

- Pepe (PEPE): A meme coin named after the popular internet meme character Pepe the Frog.

12. Governance Tokens

Governance tokens are cryptocurrencies that grant holders voting rights within a blockchain project or decentralized application (DApp). These tokens are used to vote on key protocol changes, upgrades, and other significant decisions, allowing for decentralized management of the project.

Example of Governance Tokens:

- Maker (MKR): Used to govern the MakerDAO and DAI stablecoin system, where MKR holders vote on decisions like collateralization ratios and risk parameters.

- Compound (COMP): Allows holders to participate in governance decisions for the Compound DeFi protocol, including updates to interest rates and adding new assets.

13. Platform Tokens

Platform tokens are native to blockchain platforms that enable the creation and deployment of decentralized applications (DApps). These tokens are essential for interacting with the platform’s ecosystem, often used to pay for transaction fees, deploy smart contracts, and access various services.

Example of Platform Tokens:

- Cardano (ADA): The native token of the Cardano blockchain, used for transactions, staking, and participating in governance.

- Polkadot (DOT): Used for governance, staking, and bonding within the Polkadot network, which enables the interconnection of different blockchains.

14. Forked Coins

Forked coins emerge when a blockchain undergoes a split, known as a fork, creating a new version of the blockchain with a new set of rules. The holders of the original coin typically receive the new forked coin as a form of airdrop.

Example of Forked Coins:

- Bitcoin Cash (BCH): Created from a hard fork of Bitcoin in 2017, aiming to increase transaction speed and reduce fees by increasing block size.

- Ethereum Classic (ETC): Resulted from a split in the Ethereum blockchain following the DAO hack in 2016, preserving the original blockchain before the reversal of the hacked funds.

15. NFT Tokens

Non-Fungible Tokens (NFTs) are unique digital assets that represent ownership of a specific item or piece of content, such as art, music, videos, or virtual real estate. Unlike cryptocurrencies, NFTs are not interchangeable on a one-to-one basis, making each one unique.

Example of NFT Tokens:

- CryptoPunks: One of the first NFT projects on the Ethereum blockchain, consisting of 10,000 unique collectible characters.

- Bored Ape Yacht Club (BAYC): A popular NFT collection featuring unique digital illustrations of apes with varying traits.

16. Hybrid Tokens

Hybrid tokens combine features of multiple types of cryptocurrencies. For example, they might serve as both a utility token and a governance token or have characteristics of both security and utility tokens.

Example of Hybrid Tokens:

- Chainlink (LINK): Acts as both a utility token for paying for data services on the Chainlink network and as a governance token to vote on network improvements.

- Ripple (XRP): While primarily used as a digital payment currency, XRP also serves as a bridge currency in cross-border transactions.

17. Social Tokens

Social tokens are cryptocurrencies issued by individuals, communities, or brands to create value within a specific community. These tokens can be used for various purposes, such as accessing exclusive content, participating in events, or supporting creators.

Example of Social Tokens:

- Rally (RLY): A platform that allows creators to issue their social tokens, providing fans with exclusive content and experiences.

- Whale (WHALE): A social token backed by a collection of rare NFTs, providing holders with access to unique digital assets and experiences.

ENG WANJIKU

Views: 33