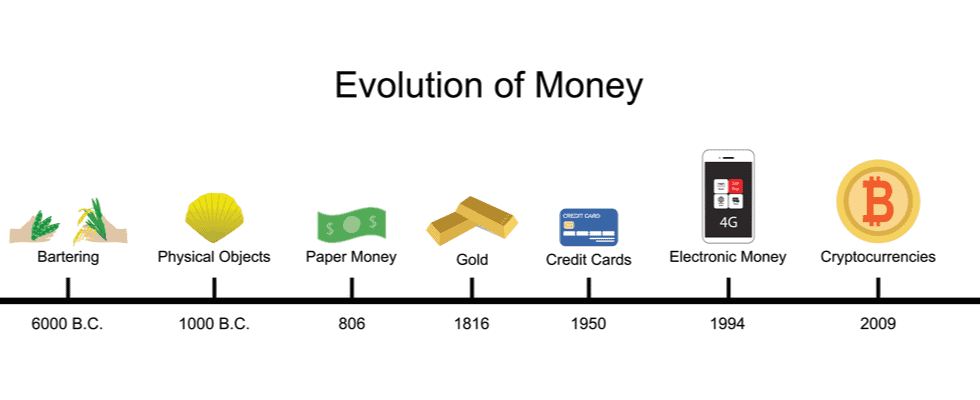

Cryptocurrency has rapidly evolved from a niche interest to a global phenomenon, attracting investors, technologists, and everyday individuals alike. But what makes this digital currency so appealing? Here’s a deep dive into why you should consider getting into crypto.

1. Potential for High Returns

Cryptocurrencies are known for their volatility, which can be both a risk and an opportunity. While prices can fluctuate wildly, this volatility also presents the potential for significant gains. Investors who carefully time their investments and understand the market can experience substantial returns.

2. Diversification

Incorporating cryptocurrencies into your investment portfolio can offer diversification, which is key to managing risk. Traditional asset classes like stocks and bonds may not always move in tandem with crypto markets, providing a hedge against market downturns in other areas of your portfolio.

3. Decentralization

One of the core principles of cryptocurrencies is decentralization. Unlike traditional financial systems, which are often controlled by central authorities like banks or governments, cryptocurrencies operate on decentralized networks. This reduces the influence of any single entity over your assets, promoting transparency and potentially leading to more democratic financial systems.

4. Global Accessibility

Cryptocurrencies are accessible to anyone with an internet connection, making them a powerful tool for global financial inclusion. They enable cross-border transactions without the need for intermediaries, often resulting in faster and cheaper transfers, especially in regions where traditional banking services are lacking.

5. Ownership and Control

When you own cryptocurrency, you have direct control over your assets. Unlike traditional financial systems where your money might be held by banks or other intermediaries, cryptocurrencies are stored in digital wallets that you manage. This control reduces the need for middlemen and gives you more autonomy over your financial decisions.

6. Hedging Against Fiat Currency Devaluation

In countries experiencing economic instability or high inflation, cryptocurrencies can serve as a hedge against the devaluation of traditional fiat currencies. For example, during times of hyperinflation, holding assets in a cryptocurrency like Bitcoin might preserve wealth more effectively than holding local currency.

7. Long-Term Store of Value

Bitcoin, often referred to as “digital gold,” has proven itself as a long-term store of value. The infamous story of the two pizzas purchased for 10,000 Bitcoins in 2010 highlights how Bitcoin’s value has soared over the years. This appreciation potential makes it an attractive option for long-term investment.

8. Technological Innovation

Investing in cryptocurrencies also means supporting and participating in technological innovation. Blockchain technology, the foundation of cryptocurrencies, has applications beyond finance, including supply chain management, healthcare, and voting systems. By getting involved in crypto, you’re also backing the future of digital technology.

9. Inflation Resistance

Many cryptocurrencies, like Bitcoin, have a capped supply, meaning that only a finite number will ever be created. This scarcity model is in contrast to fiat currencies, which can be printed in unlimited quantities by central banks, leading to inflation. The finite supply of certain cryptocurrencies can make them more resistant to inflation over time.

10. Financial Sovereignty

Cryptocurrencies offer a level of financial sovereignty that is unmatched by traditional financial systems. With crypto, you can make transactions without the need for banks, credit card companies, or other intermediaries, allowing for greater privacy and control over your financial life.

11. Increasing Adoption

As more businesses, governments, and institutions begin to accept and integrate cryptocurrencies into their operations, the utility and value of these digital assets are likely to increase. This growing adoption can drive demand, leading to potential appreciation in the value of cryptocurrencies.

12. Participation in a Growing Ecosystem

The crypto ecosystem is rapidly expanding, with new projects, tokens, and use cases emerging regularly. By getting involved now, you can be part of a pioneering community that is shaping the future of finance and beyond.

Conclusion

The decision to invest in cryptocurrencies should not be taken lightly, as the market is known for its volatility. However, the potential benefits—ranging from high returns and diversification to technological innovation and financial sovereignty—make it a compelling option for those willing to explore this new frontier. Whether you’re looking to hedge against inflation, diversify your portfolio, or simply be part of a revolutionary movement, getting into crypto could be a worthwhile consideration.

ENG WANJIKU

Views: 17