World’s 5th Top Crypto Investor Loses $43.5M: A Stark Reminder of Market Volatility

In the world of cryptocurrency, even the most successful investors are not immune to market volatility. A prime example of this is James Fickel, the fifth-largest crypto investor globally, who recently lost a staggering $43.5 million while trading the BTC/ETH pair. Fickel, known for his strategic investments and vast market insights, fell victim to one of the cruelest realities of the crypto market—its unpredictability.

The Crypto Market’s Unforgiving Nature

The cryptocurrency market, driven by speculation and rapid price fluctuations, is notorious for its volatility. While some traders manage to profit during favorable conditions, others, even experienced investors like Fickel, can face massive losses. The market’s current bearish trend has led to significant declines for many cryptos, with only a few managing to show gains. This downturn has heavily impacted major holders like Fickel, despite his history of making millions from previous trades.

James Fickel’s $43.5M Loss in BTC/ETH Trading

Fickel’s downfall began earlier this year, with what seemed like a calculated but high-stakes move. From January to July, he borrowed 3,061 Wrapped Bitcoin (WBTC), worth approximately $172 million, from the DeFi platform Aave. He then exchanged this amount for 56,445 ETH at a rate of 0.05424 ETH per WBTC. Initially, the trade appeared promising, as market conditions at that time were favorable. However, as the year progressed, market trends shifted, and Fickel’s strategy quickly unraveled.

By mid-2024, Ethereum began underperforming compared to Bitcoin. The ETH price relative to Bitcoin dropped by 24% year-to-date (YTD) and by 9% in the past month alone. This market downturn drastically affected Fickel’s investments, and by July, his losses mounted to 18,000 ETH, valued at approximately $43.5 million.

Attempts to Recover: Doubling Down on a Losing Trade

Despite these early losses, Fickel continued to trade in an attempt to recover. In August, he devised a new strategy: purchasing more WBTC to mitigate his growing debt to Aave. He spent $12 million in USDC to buy 211 WBTC, hoping to leverage these tokens for a recovery. However, market conditions did not improve, and the price of Ethereum continued to decline. Fickel then exchanged 16,000 ETH to buy an additional 671 WBTC worth $39.9 million.

The move, while bold, proved costly. By the time he exchanged the ETH for WBTC, the ETH/BTC exchange rate had dropped to $0.042. This unfavorable exchange further deepened his losses, pushing his debt to Aave even higher.

Ethereum’s Underperformance and Fickel’s Commitment to DeFi

One of the most striking aspects of Fickel’s loss is his unwavering commitment to the Ethereum ecosystem, despite its recent poor performance. Throughout the year, Ethereum has struggled, particularly when compared to Bitcoin. At the time of writing, ETH is priced at $2,400, a significant decline from its previous highs.

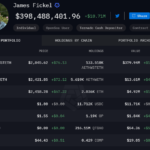

Despite these setbacks, Fickel continues to hold $400 million worth of cryptocurrency, with all of it tied up in Ethereum derivatives. However, his massive debt to Aave—totaling $130,964,731.17—means that much of this wealth is effectively locked. This highlights a common risk in the decentralized finance (DeFi) space, where leveraging assets to trade can lead to substantial losses if market conditions move against an investor.

Lessons from Fickel’s Experience: The Risks of Leverage and Market Timing

Fickel’s loss serves as a powerful reminder that not all trades, even those made by seasoned professionals, result in profit. The use of leverage, particularly in a volatile market, can amplify both gains and losses. Fickel’s decision to borrow large sums of WBTC from Aave to trade against Ethereum might have been rooted in sound market analysis, but the unpredictable nature of cryptocurrency ultimately worked against him.

His experience underscores the importance of risk management in crypto trading. No matter how much knowledge or experience an investor has, market volatility remains an ever-present threat. The crypto market is known for its rapid, unpredictable price swings, and timing the market perfectly is next to impossible, even for top investors like Fickel.

The Broader Market: Winners Amid the Losses

While Fickel faced significant losses, not all traders suffered the same fate. For instance, some TRON traders managed to make $7.4 million during the same period. This contrast illustrates the dual nature of the cryptocurrency market—while one side faces heavy losses, others manage to profit. This dynamic is what makes the market both enticing and dangerous for investors.

Conclusion

James Fickel’s $43.5 million loss in the BTC/ETH trading pair is a cautionary tale for all crypto investors. It highlights the inherent risks of trading in a volatile market and the potential pitfalls of over-leveraging. Despite his expertise and successful track record, Fickel’s experience shows that no one is immune to the market’s unpredictable swings. As the cryptocurrency market continues to evolve, traders must remain vigilant, manage risk carefully, and remember that even the most strategic trades can go wrong in the face of volatility.

ENG WANJIKU

Views: 3